safeonlinereputation.ru

Overview

Fees On Binance Us

What Are safeonlinereputation.ru Fees? ; 3, $50, – $,, Free, %, % ; 4, $, – $1,,, Free, %, %. The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. Discover competitive Binance fees for trading, deposits, and withdrawals on the leading cryptocurrency exchange. Learn about Binance fee tiers today! Binance Trading Fees (Spot Trading) Binance offers a flat trading fee of %. Accordingly, Binance does not care about whether you are a taker or a maker. Is safeonlinereputation.ru Cheaper Than Coinbase Advanced Trader? Yes, safeonlinereputation.ru offers zero fees on Tier 0 pairs and a high of % maker and % taker fees on Tier 1. safeonlinereputation.ru trading fees start at % and are quickly reduced each trade a user executes, making them one of the most attractive places to trade. Reduced Fees. While competitors have trading fees starting at %, maker/taker fees on safeonlinereputation.ru range from 0% to %. Instant buy fees are %. Users who hold BNC. Start your crypto portfolio in as little as two minutes. Easily trade BTC with $0 fees on a select pair. All it takes is a few quick taps to start trading on. safeonlinereputation.ru Crypto Converter ; 0% Fees. Convert crypto or USD with no transaction fees. ; Quick & Easy. Exchange crypto near instantly, in just a few clicks. What Are safeonlinereputation.ru Fees? ; 3, $50, – $,, Free, %, % ; 4, $, – $1,,, Free, %, %. The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. Discover competitive Binance fees for trading, deposits, and withdrawals on the leading cryptocurrency exchange. Learn about Binance fee tiers today! Binance Trading Fees (Spot Trading) Binance offers a flat trading fee of %. Accordingly, Binance does not care about whether you are a taker or a maker. Is safeonlinereputation.ru Cheaper Than Coinbase Advanced Trader? Yes, safeonlinereputation.ru offers zero fees on Tier 0 pairs and a high of % maker and % taker fees on Tier 1. safeonlinereputation.ru trading fees start at % and are quickly reduced each trade a user executes, making them one of the most attractive places to trade. Reduced Fees. While competitors have trading fees starting at %, maker/taker fees on safeonlinereputation.ru range from 0% to %. Instant buy fees are %. Users who hold BNC. Start your crypto portfolio in as little as two minutes. Easily trade BTC with $0 fees on a select pair. All it takes is a few quick taps to start trading on. safeonlinereputation.ru Crypto Converter ; 0% Fees. Convert crypto or USD with no transaction fees. ; Quick & Easy. Exchange crypto near instantly, in just a few clicks.

Be sure to check the safeonlinereputation.ru website, which provides up-to-date information for each type of cryptocurrency. There are ways to lower withdrawal fees, and it. Well, by default Binance charges 1% as trading fees, and by following the tricks mentioned in this article and embedded video, you will be able to save a. Binance comparison to several other U.S. exchanges, such as eToro (which costs roughly percent for Bitcoin transactions) and Coinbase . Fee Schedules for trading on the safeonlinereputation.ru Exchange. Trading fees are determined based on your trading volume over a day period (in USD). Unlike other crypto exchanges, we charge 0% transaction fees when you buy or trade Bitcoin on select pairs, and we offer some of the lowest fees on. Unlike other crypto exchanges, we charge 0% transaction fees when you buy or trade Bitcoin on select pairs, and we offer some of the lowest fees on. The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. Both exchanges differ in terms of deposit and withdrawal methods, liquidity and trading fees. Moreover, the U.S. platform offers users fewer cryptocurrencies. Log in and see a full overview of your fee and transaction history. Log In. Community. Theme. Theme. About Us. About · Careers · Announcements · News. Though the trading fees are low, depositing funds on the exchange via debit cards fetches a relatively high fee of percent. The better options for. Currently, users can find % spot trading fees on Binance and zero-fee Bitcoin trading on safeonlinereputation.ru Binance: Binance has some of the lowest fees in the. safeonlinereputation.ru is the leading crypto platform trusted by millions of customers in the U.S. Securely buy and sell bitcoin and + cryptocurrencies with some of. Binance Smart Chain Average Transaction Fee is at a current level of , down from yesterday and up from one year ago. This is a change of -. safeonlinereputation.ru now offers zero-fee trading on four bitcoin spot market pairs and has plans to add other tokens to the no-fee list in the future. Incredibly low trading fees · Holding BNB lowers trading fees even further · Free tax portal · Robust and readable Binance Academy · DIY security toggles from main. Access + cryptocurrencies and explore the world of Web3 with confidence. U.S. regulated. Trusted by millions. @BinanceUShelp. When it comes to crypto, eToro offers 85 cryptocurrencies to buy, sell, and trade, with a simple 1% fee structure. As well as this, eToro offers crypto CFDs and. When it comes to crypto, eToro offers 85 cryptocurrencies to buy, sell, and trade, with a simple 1% fee structure. As well as this, eToro offers crypto CFDs and. Binance comparison to several other U.S. exchanges, such as eToro (which costs roughly percent for Bitcoin transactions) and Coinbase . Fees. % trading fee ; Fiat Deposit. USD ; Withdrawal. USD 15 BTC ETH LTC USDT BNB XRP BCH ; Accepted Payment Methods.

Investing 8 Million Dollars

Investing a significant amount of money, like 2 million dollars, can be both exciting and daunting. However, with the right investment strategies, you can grow. Mutual Funds vs Stocks - Comparison. By Dennis Hammer. 8 min read. Stocks and mutual funds are popular securities for amateur and expert investors alike. Learn. Wondering how to save a million dollars? Use our millionaire calculator to determine how much you need to save and when you'll become a millionaire. Alberta has invested billions of dollars Since commercial operations began in , the Quest Project has captured and stored over 8 million tonnes of CO2. Dollars (usd). Leave this field blank. Investment Date, Original Shares 8 A.M. and 8 P.M. Eastern Time, Monday through Friday, and Saturday 9 A.M. Investors with $, to $1 million*. You're a Voyager Select client at Vanguard, which offers you a team of experienced investment professionals. Your. This investment returns calculator can help you estimate annual gains. Learn if you're on track to meet your long-term goals. We spoke to six experts about where they'd invest $1 million right now. Ideas include municipal bonds, European and Japanese equities, and dividend-paying US. $ per month invested over a period of 20 years will get you to $1 Million - assuming the invested amount returns an average of 8% per year. Investing a significant amount of money, like 2 million dollars, can be both exciting and daunting. However, with the right investment strategies, you can grow. Mutual Funds vs Stocks - Comparison. By Dennis Hammer. 8 min read. Stocks and mutual funds are popular securities for amateur and expert investors alike. Learn. Wondering how to save a million dollars? Use our millionaire calculator to determine how much you need to save and when you'll become a millionaire. Alberta has invested billions of dollars Since commercial operations began in , the Quest Project has captured and stored over 8 million tonnes of CO2. Dollars (usd). Leave this field blank. Investment Date, Original Shares 8 A.M. and 8 P.M. Eastern Time, Monday through Friday, and Saturday 9 A.M. Investors with $, to $1 million*. You're a Voyager Select client at Vanguard, which offers you a team of experienced investment professionals. Your. This investment returns calculator can help you estimate annual gains. Learn if you're on track to meet your long-term goals. We spoke to six experts about where they'd invest $1 million right now. Ideas include municipal bonds, European and Japanese equities, and dividend-paying US. $ per month invested over a period of 20 years will get you to $1 Million - assuming the invested amount returns an average of 8% per year.

stocks, 15% international stocks, 35% bonds and 5% cash investments. CRSP was used for small-cap stocks prior to , and Ibbotson U.S. day Treasury. Monday through Friday, 8 a.m. to 8 p.m., Eastern time. A couple looking Exclusive investing solutions, including private equity and closed funds. Different investment strategies affect your savings goal – $1 million in A million dollars in a retirement account might produce enough income for. Please enter a value between % and %. Show returns in: Real (net of inflation) dollars The Call Centre is open from a.m. to p.m., EST Monday. $10 million sounds like the ideal amount of money to retire with. With $10 million, you can easily generate between $, – $, of low-risk investment. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. Season 6 | Episode 8: Why is there so much gold at Fort Knox? Million million to-date and invest more than $20 million. The Sy Syms Foundation. Enter a dollar value of an investment at the outset. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click. Monday through Friday, 8 a.m. to 8 p.m., Eastern time. A couple looking All investing is subject to risk, including the possible loss of the money. *The accumulated investment savings by age 65 could provide an annual retirement income, adjusted for future inflation (in today's dollars), of this amount for. investment in today's dollars. If this box is unchecked, it will show the actual value of the investment. Compare Investments and Savings Accounts. INVESTMENTS. For the tax year, the maximum contribution is $23,, increasing Saving and investing your money can help you make a million dollars. By. Interest calculator for a $8 million investment. How much will my investment of 8,, dollars be worth in the future? 8%, 10%. 0, 8,,, 8,, Think about it - that's a cool half-million dollars for finishing high Investing is critical. Many people feel “investor” is not a word that applies to. Read amassed a fortune of almost $8 million by investing in dividend-producing stocks A $ million dollar expansion of Brattleboro Memorial Hospital. 8%. 12%. Initial If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. 8. Jennifer wants to take some of her savings and invest in a mutual fund because mutual funds are. C. managed by experts at picking investments. Most. This guidebook provides an overview of the clean energy, climate mitigation and resilience, agriculture, and conservation-related investment programs. Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. million dollars in retirement. But after that, we suggest adopting a Each individual investor should consider these risks carefully before investing in a.

Places Like Kickstarter

Platforms like Kickstarter make money by charging a small platform fee, whereas some of the best crowdfunding platforms specialize in helping creatives. The goal of Kickstarter is to empower creators to get funding without changing their vision for their project. In other words, it's a great way to get the funds. 10 Best Kickstarter Alternatives of · 1. Indiegogo · 2. StartEngine · 3. GoFundMe · 4. Patreon · 5. FundRazr · 6. SeedInvest · 7. Chuffed · 8. WeFunder. Kickstarter is a platform that aims to bring people together and bring their creative ideas to life. Listen in and learn more as Russell talks about how this. platforms like Kickstarter and Indiegogo. Creating a landing page is one sure way to build awareness and excitement about your Kickstarter launch. With a. Promoting your crowdfunding project, whether it's Kickstarter, Indiegogo, or another platform like Kickstarter, Crowdfunding, Gaming, Music, and more. On. Platforms like Kickstarter make money by charging a small platform fee, whereas some of the best crowdfunding platforms specialize in helping creatives . Places. Publishing. All of Publishing; Academic; Anthologies; Art Books; Calendars No Escape: the puzzle escape experience like no other. Tabletop Games. We are sharing the list of best crowdfunding sites and companies to help you get an idea of competition. Platforms like Kickstarter make money by charging a small platform fee, whereas some of the best crowdfunding platforms specialize in helping creatives. The goal of Kickstarter is to empower creators to get funding without changing their vision for their project. In other words, it's a great way to get the funds. 10 Best Kickstarter Alternatives of · 1. Indiegogo · 2. StartEngine · 3. GoFundMe · 4. Patreon · 5. FundRazr · 6. SeedInvest · 7. Chuffed · 8. WeFunder. Kickstarter is a platform that aims to bring people together and bring their creative ideas to life. Listen in and learn more as Russell talks about how this. platforms like Kickstarter and Indiegogo. Creating a landing page is one sure way to build awareness and excitement about your Kickstarter launch. With a. Promoting your crowdfunding project, whether it's Kickstarter, Indiegogo, or another platform like Kickstarter, Crowdfunding, Gaming, Music, and more. On. Platforms like Kickstarter make money by charging a small platform fee, whereas some of the best crowdfunding platforms specialize in helping creatives . Places. Publishing. All of Publishing; Academic; Anthologies; Art Books; Calendars No Escape: the puzzle escape experience like no other. Tabletop Games. We are sharing the list of best crowdfunding sites and companies to help you get an idea of competition.

Well, there is indiegogo. Kickstarter is the best at generating organic traffic though. Nevertheless, unless you have some viral idea you need. We've scoured the crowdfunding landscape to bring you the 11 best Kickstarter alternatives, ensuring you have all the options at your fingertips. Types of Kickstarter Projects, by City. Similar Cities to New York. Select City ▽. Project lists. Upcoming · Crowdfunding · Late Pledge · Preorders & Stores. popular Explore. You may like Active Ending soon Accepting Stretch Pay · Cyberpunk. Top 5 Crowdfunding Sites for Gamers · 1. Gamefound · 2. GameOnTableTop · 3. Pozible · 4. Kickstarter · 5. Indiegogo. like Sarah. Or, if you're ready to apply, get started by clicking the button Kickstarter and other crowdfunding platforms are great places to find. People are willing to directly donate to you via sites like Patreon. People are also willing to directly invest in you via sites like Kickstarter. Like Facebook, LinkedIn has several groups set up to allow creators to promote their ideas. You can also feature a link to your Kickstarter page at the top of. If you're looking for examples of real crowdfunding campaigns hosted by (or benefiting) nonprofits like yours, you've come to the right place. Check out. Engage in conversations using hashtags related to your topic area, as well as regular Twitter chats related to crowdfunding and places like Kickstarter Live. Easyship can help you navigate the road to success as a partner of crowdfunding sites like Kickstarter. You can use our free crowdfunding campaign cost. Kickstarter exists to help bring creative projects to life. A home for film, music, art, theater, games, comics, design, photography, and more. I know that kickstarter only allows open source software projects, but was wondering if there are other sites out there like kickstarter but for. The two most popular Crowdfunding platforms are IndieGoGo and Kickstarter. · You need to research where potential backers are hanging out the. 1. Seedrs · 2. Crowdcube · 3. Kickstarter · 4. Indiegogo · 5. Code Investing · 6. Ethex · 7. Triodos · 8. Funding Circle. Kicktraq is like Google Analytics for Kickstarter campaigns. It's more of a tool that tracks data, issues forecasts and showcases the most. like they're less alone because I'm in there with them. I'm also helping them connect with other people who are in there with them. So I drive them to places. Comparing the Top Online Fundraising and Crowdfunding Platforms ; GoFundMe. $25B · 50M ; Indiegogo. $B · 10M ; Kickstarter. $3B · 15M ; Fundly. $M · NA. Kickstarter is a GoFundMe alternative that offers a platform for projects that span across various categories like arts, comics and illustration, design and. Kickstarter and Indiegogo are the two most popular rewards-based crowdfunding platforms. Each has a unique set of strengths.

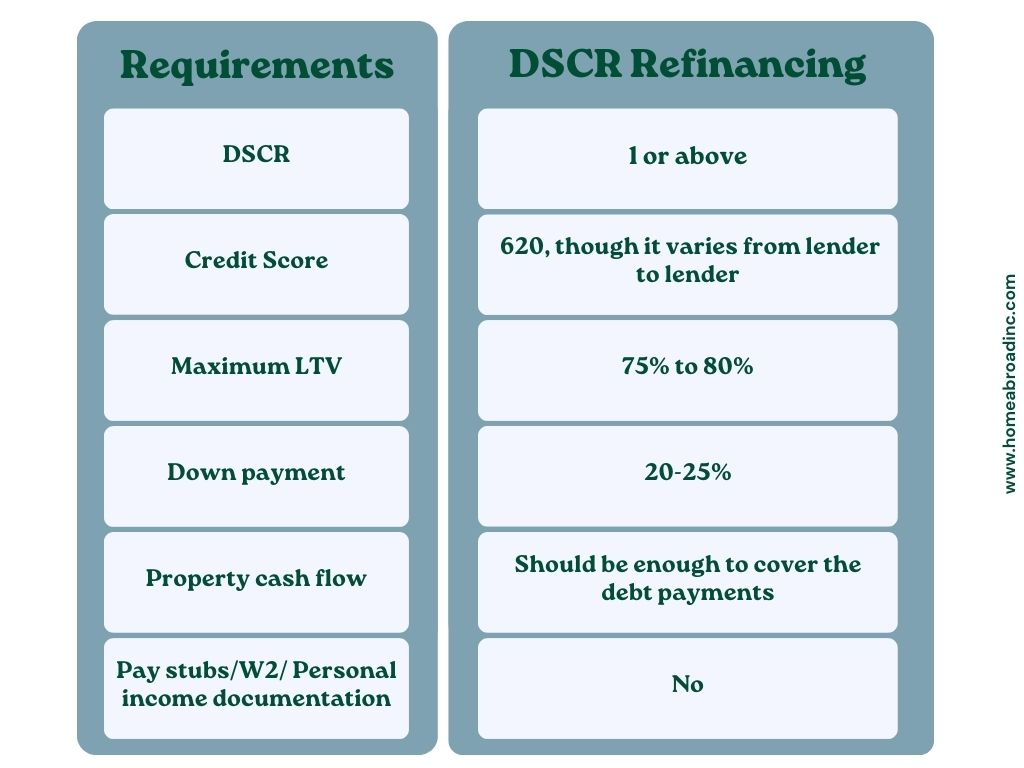

Is It A Good Idea To Refinance Student Loans

Refinancing federal loans can be tempting if you're looking for a lower rate, but remember you'll lose federal protections like income-driven. Should I Refinance My Student Loans? Depending on how long you've been out of school, your annual income and credit history is likely to have improved. By. I would review the option to refinance the student loans first, they offer better rates on student loans versus getting a 2nd mortgage. Because the interest rate is a weighted average and not necessarily reduced, federal student loan consolidation is generally not a money-saving option. However. Refinancing lets you trade in your high-rate student debt for one low-rate loan with a single monthly payment. The main benefit of refinancing student loans is qualifying for a better interest rate than you have now. Refinancing also lets you restructure your repayment. Refinancing private loans is almost always a good idea if the numbers work out in your favor and you can save money from reduced interest. Student loan refinancing is about saving money If you've heard a lot of buzz about refinancing student loans, there's a good reason why: It could potentially. For example, if you can qualify for a lower interest rate or better repayment terms, it could be a good idea to refinance. But if you have poor credit or. Refinancing federal loans can be tempting if you're looking for a lower rate, but remember you'll lose federal protections like income-driven. Should I Refinance My Student Loans? Depending on how long you've been out of school, your annual income and credit history is likely to have improved. By. I would review the option to refinance the student loans first, they offer better rates on student loans versus getting a 2nd mortgage. Because the interest rate is a weighted average and not necessarily reduced, federal student loan consolidation is generally not a money-saving option. However. Refinancing lets you trade in your high-rate student debt for one low-rate loan with a single monthly payment. The main benefit of refinancing student loans is qualifying for a better interest rate than you have now. Refinancing also lets you restructure your repayment. Refinancing private loans is almost always a good idea if the numbers work out in your favor and you can save money from reduced interest. Student loan refinancing is about saving money If you've heard a lot of buzz about refinancing student loans, there's a good reason why: It could potentially. For example, if you can qualify for a lower interest rate or better repayment terms, it could be a good idea to refinance. But if you have poor credit or.

A cash-out refinance will give you money in a lump sum that you can use to pay for student loans and college expenses. · The cash-out refinance interest rate may. Borrowers refinance student loans with lenders like SoFi and Earnest to get a lower interest rate, which helps save money and pay off your student loan debt. Is student loan refinancing worth it? For some, yes. It's a good idea to understand the topic and know your goals in order to decide whether to refinance. When you refinance student loans, you could qualify for a much lower rate than you currently have — allowing you to save thousands on lifetime interest. It's normally absolutely not recommended because you lose any benefits/forgiveness and all IDR plans, but % is quite high and your income is. You can still do this with federal student loans; however, you will be stripped of your eligibility for federal loan forgiveness programs and repayment plans. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily. Unlike most federal loans, you'll need to show that you're creditworthy to secure a student loan refinance with a private lender — or have a cosigner with good. You should only refinance your student loans if: · It's % free. · You can get a lower interest rate. · You can keep a fixed rate or trade your variable rate for. Letting your student debt pile up year after year without taking action to pay it off is not a good idea. Ignore it long enough and you'll eventually find your. Although the U.S. Department of Education permits student loan consolidation with Direct Consolidation Loans, it doesn't allow borrowers to refinance their debt. Refinancing your federal and/or private student loans can be a great way to consolidate payments and potentially save money on interest over time. The biggest drawback of refinancing your student loans is giving up the protections that you otherwise receive with federal loans, such as income-driven. Private refinancing could save you money. But refinancing federal student loans could cost you benefits that only they provide. There is no one-size-fits-all. To qualify for the best refinancing rates, you'll need to prove that you're a low-risk borrower. Steady income and a strong credit score are the two main points. Pros and cons of refinancing student loans · Pro: The biggest one is that you could qualify for a lower interest rate, which could free up money for other. However, if you feel financially stable, have good to excellent credit and the market is in a good place offering low interest rates, then it might just be time. Refinancing is a great option for any individual carrying high-interest debts. If your credit score has increased since taking out your original debt, then. If that is your goal and you qualify for a lower interest rate loan, refinancing can definitely help you pay less overall. Just be sure the new loan term is. Savings vary based on rate and term of your existing and refinanced loan(s). Refinancing to a longer term may lower your monthly payments, but may also increase.

Active Vs Passive Funds Performance

Active investors can benefit from professional monitoring of the performance of an actively managed fund—and of the fund manager. The outcomes of an actively. The rise of ETF investing, coupled with generally poor relative performance from active equity managers in recent years, has caused many to assume that active. Active strategies have tended to benefit investors more in certain investing climates, and passive strategies have tended to outperform in others. For example. The first is known as an active investing strategy, while the second is passive investing. Passive index funds or an actively managed portfolio — the choice. As mentioned earlier, passive funds do not involve the active participation of a fund manager. Hence their fee is far less as compared to that charged by an. Passive index funds follow a benchmark and deliver returns similar to the total returns of the securities represented in the benchmark prior expense ratio and. When all goes well, active investing can deliver better performance over time. But when it doesn't, an active fund's performance can lag that of its benchmark. Passive funds are usually cheaper than their active counterparts. They mirror specific indices but are meant to match—not beat—the index performance. Some. Passive management typically refers to funds that simply mirror the composition and performance of a specific index, such as the S&P ® Index. The S&P is. Active investors can benefit from professional monitoring of the performance of an actively managed fund—and of the fund manager. The outcomes of an actively. The rise of ETF investing, coupled with generally poor relative performance from active equity managers in recent years, has caused many to assume that active. Active strategies have tended to benefit investors more in certain investing climates, and passive strategies have tended to outperform in others. For example. The first is known as an active investing strategy, while the second is passive investing. Passive index funds or an actively managed portfolio — the choice. As mentioned earlier, passive funds do not involve the active participation of a fund manager. Hence their fee is far less as compared to that charged by an. Passive index funds follow a benchmark and deliver returns similar to the total returns of the securities represented in the benchmark prior expense ratio and. When all goes well, active investing can deliver better performance over time. But when it doesn't, an active fund's performance can lag that of its benchmark. Passive funds are usually cheaper than their active counterparts. They mirror specific indices but are meant to match—not beat—the index performance. Some. Passive management typically refers to funds that simply mirror the composition and performance of a specific index, such as the S&P ® Index. The S&P is.

Passive investing also offers lower fees compared to active investing. Since passive funds don't require professional fund managers to make investment decisions. It is important to note that during periods in which passively managed funds are said to be outperforming actively managed funds, they are typically referring. ESG ratings matter to passive-fund investors, tracking bespoke indices. • Investors will look beyond ratings when assessing ESG performance. • Knowing the. Active management is much more challenging than passive investing when it comes to beating benchmarks, particularly through the volatile periods seen in the. When all goes well, active investing can deliver better performance over time. But when it doesn't, an active fund's performance can lag that of its benchmark. What is Active and Passive Investing? Active fund managers attempt to beat the market (or their particular benchmark) by picking and choosing among. In contrast, passive funds have performed better than active funds in the last few, relatively calm years. As the markets become more volatile, including during. ETFs investing in equity amounted to EUR bn Between. and , the share of passively managed equity funds and equity ETFs increased significantly (V. Passive investing, meanwhile, seeks to track or mirror a market index rather than beat it. Many investors want to know if it's better to purchase an actively. This section summarises the performance of active funds in the US over the last 15 years, relative to their passive benchmarks. There is some evidence that institutional active managers and active funds perform better than the market before fees. However, this is probably. Because the general trend in stock market performance over long horizons tends to be positive and because passive funds have been shown to consistently. In simple terms, active investors attempt to outperform the returns of a specific benchmark, whereas passive investors accept the market return by tracking a. The numbers don't lie. Active has higher fees and once your account grows, so do the fees that eat up your gains. And of course, performance is overall better. Passive vs Active Investing · Passive. Attempts to replicate the returns of an index or asset class, does not target excess returns, instead matches the. Active funds have a fund manager who selects stocks and bonds to buy and sell, while passive funds follow a benchmark index and replicate its performance. What. Active investors buy and sell assets in an effort to outperform the market. Passive investors take a buy-and-hold approach, limiting the number of transactions. What is Active and Passive Investing? Active fund managers attempt to beat the market (or their particular benchmark) by picking and choosing among. Portfolio ; Index mutual fund or ETF, Actively managed fund ; Goal, Tries to match the performance of a specific market benchmark (or "index") as closely as. The fees charged are higher than passively managed funds, lowering the potential returns. Some fund managers charge performance fees on top of the management.

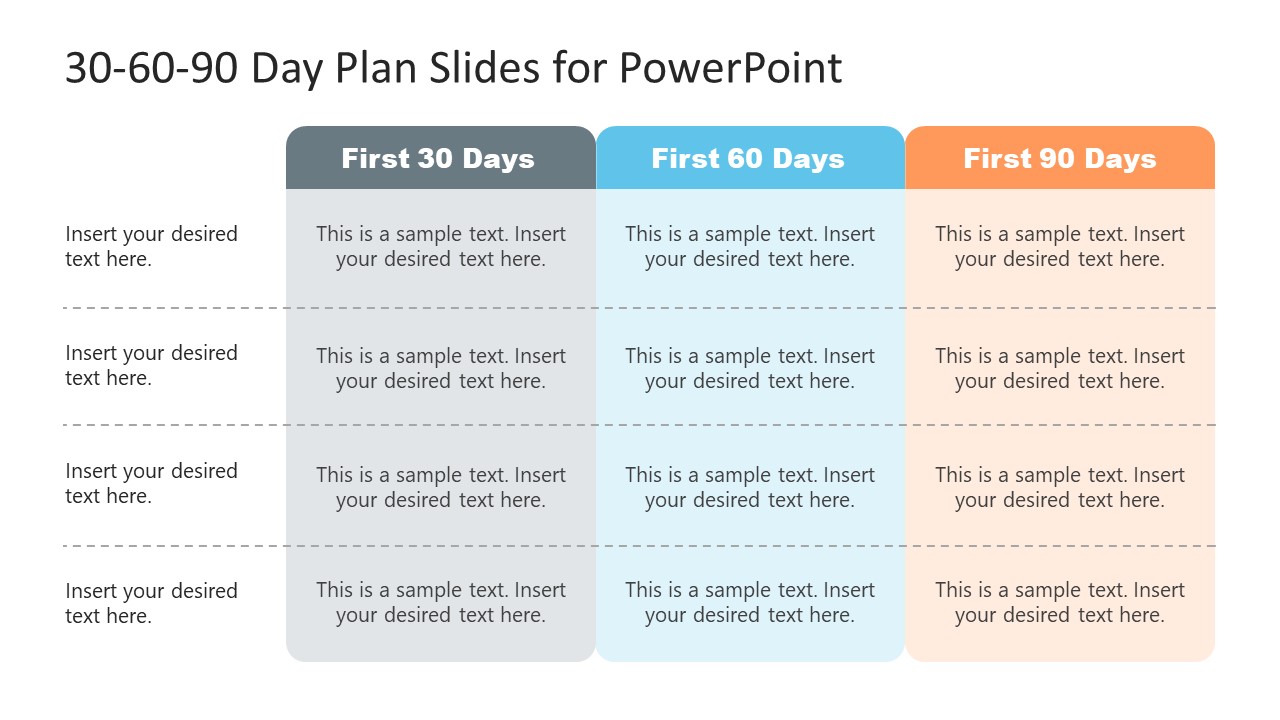

30 69 90 Day Plan

If you're a new manager who wants to plan for success, then review a free day plan template for managers and learn how to create your own. 69, 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, 88, 89, 90, 91, 92, 93, 94 day refund/replacement. day refund/replacement. Use the first 30 days to learn - that might mean learning the teams strengths, weaknesses and opportunities to grow. It will also mean learning what your. That's scary stuff, but here's the good news: 69 Use Trello's 30, 60, and 90 Day Plan template for onboarding, or try the Confluence Cloud day template. 71 You will find guiding details on how you can hit each of the above targets in the next training segment, Your Business Plan. 70, CLICK HERE TO CREATE IN SMARTSHEET Day , 1. day onboarding plan for new employees. Great onboarding processes matter. In fact, they matter so much that 69% of employees are more likely to stay. A 30/60/90 Day Plan is a strategic outline of the job expectations for the new employee over the first 90 days. A day marketing plan sets the direction and tone for your leadership, helps effectively share your vision and goals, and provides a framework to help you. If you're a new manager who wants to plan for success, then review a free day plan template for managers and learn how to create your own. 69, 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, 88, 89, 90, 91, 92, 93, 94 day refund/replacement. day refund/replacement. Use the first 30 days to learn - that might mean learning the teams strengths, weaknesses and opportunities to grow. It will also mean learning what your. That's scary stuff, but here's the good news: 69 Use Trello's 30, 60, and 90 Day Plan template for onboarding, or try the Confluence Cloud day template. 71 You will find guiding details on how you can hit each of the above targets in the next training segment, Your Business Plan. 70, CLICK HERE TO CREATE IN SMARTSHEET Day , 1. day onboarding plan for new employees. Great onboarding processes matter. In fact, they matter so much that 69% of employees are more likely to stay. A 30/60/90 Day Plan is a strategic outline of the job expectations for the new employee over the first 90 days. A day marketing plan sets the direction and tone for your leadership, helps effectively share your vision and goals, and provides a framework to help you.

We've compiled a variety of useful day business plan templates. Download them in PDF, Word, and Excel formats for free. A day sales plan outlines in detail how a new sales rep or manager intends to approach their first three months on the job. 30 60 90 Day Sales Plan Powerpoint Templates. Create your presentation by reusing a template from our community or transition your PowerPoint deck into a. plan to help you create your goals for the next 90 days which should make this step a lot easier. Then, simplify all your tasks into 30/60/ day increments so. Part of my “Homework” for this interview is to prepare a PowerPoint presentation of my 30/60/90 day plan to grow the assigned territory. DAY ROADMAP TO SETTING UP A CONGRESSIONAL OFFICE. Step 5: Be sure Management Guide, its signature publication, for more than 30 years. • In. 30 December of the year in which you turn You can consult your Under the provisions of your plan, up to 90 days (called a day bank) can. The day sales plan gives reps and managers alignment on what success will look like in the first 30, 60, and 90 days. If you're an executive joining a new company or interviewing for a job, there's a good chance you'll be asked to prepare a 30 60 90 day plan. I feel like a failure. · Month 3 Workout Plan | 90 Day Journey to Muscle · Day 60 Results | 90 Day Journey to Muscle · Week 8 Meal Plan Update | Day 49 of 90 · Week. A Day Plan is a written outline of your strategy, and the plans you have for the first three months on the job. A 30/60/90 Day Plan is a strategic outline of the job expectations for the new employee over the first 90 days. Day Plan (Basic). The basic 30 60 90 day plan is the perfect tool to stand out in a job interview, and to ensure you guarantee you'll leave the first. In fact, 69% of employees say they're more likely to stay with a The crucial step to creating an effective day plan is establishing context. How New Managers Can Build Leadership Success With a Day Plan A PwC study showed that 69% of corporations that managed to adapt during. A day plan can help set personal and professional goals when entering a position within an organisation. 30 minutes a day. In 90 days (two “grace days” are included) you'll see the Psalms Psalms Psalms Psalms Psalms The Innovative Samurai set out on a quest to capture 60 out of 90 sunrises as part of his 90 day plan 14C/58F Breathtaking is how we describe today's. Leadership is asking for a 30/60/90 day game plan on how I would lead our SE team. Looking for advice and resources. My direct manager left. A day plan can help a hiring manager set goals by providing both the employee and leadership team with an actionable path and targets that can be.

How Much Is Dna Testing For A Dog

Price List for Canine DNA Tests ; Canine Genetic Disorders and Coat Color Testing. Orivet Genetic Pet Care offers breeders, pet owners & veterinarians the most advanced, innovative, easy to use Dog and Cat DNA tests in the world. Costs for high-quality dog DNA tests for a single animal range from $60 to $ (and up, depending on the lab) when ordering directly from an accredited. The cost of dog DNA tests typically falls within the range of $ to $ Generally, higher-priced tests offer more comprehensive DNA analysis. However, we. Paw Print Parentage is a DNA test that can be used to verify the sire of your puppies. The test compares the DNA of each puppy to the dam and potential sire(s). Our Dog Paternity Test is a quick and easy way to accurately determine the parentage of a dog, by measuring DNA markers. Dog DNA tests typically range anywhere from $60 to $ depending on how deep you want to dive into your dog's genetics. Where some tests only include your. You'll get the results approximately in 2 weeks from receipt of your dog's DNA test sample. The report includes all of the breeds and genetic age of your dog. ACTIONABLE HEALTH INSIGHTS: Test for over genetic health conditions and get actionable insights to help you give your pup the best care possible. Price List for Canine DNA Tests ; Canine Genetic Disorders and Coat Color Testing. Orivet Genetic Pet Care offers breeders, pet owners & veterinarians the most advanced, innovative, easy to use Dog and Cat DNA tests in the world. Costs for high-quality dog DNA tests for a single animal range from $60 to $ (and up, depending on the lab) when ordering directly from an accredited. The cost of dog DNA tests typically falls within the range of $ to $ Generally, higher-priced tests offer more comprehensive DNA analysis. However, we. Paw Print Parentage is a DNA test that can be used to verify the sire of your puppies. The test compares the DNA of each puppy to the dam and potential sire(s). Our Dog Paternity Test is a quick and easy way to accurately determine the parentage of a dog, by measuring DNA markers. Dog DNA tests typically range anywhere from $60 to $ depending on how deep you want to dive into your dog's genetics. Where some tests only include your. You'll get the results approximately in 2 weeks from receipt of your dog's DNA test sample. The report includes all of the breeds and genetic age of your dog. ACTIONABLE HEALTH INSIGHTS: Test for over genetic health conditions and get actionable insights to help you give your pup the best care possible.

Details: The standard test costs about $ and provides information on breed identification, ancestry, and traits. The more comprehensive test. Haha, same - for all 3 of the dogs I've had & tested! They cost a grand total of $ ($50, $, and free), while the tests were $ each. DNA test results include your dog's breed mix by percentage based on a library of anywhere from unique dog breeds. In the average cost of an at-home dog DNA test kit ranges from about $60 to $ These tests analyze specific genetic markers in your dog's DNA to help. A prepaid AKC DNA Kit costs $55 (per dog). This test provides markers for genetic identity, which is used for parentage verification. A dog paternity test is carried out by comparing the DNA profiles of the dam (mother) and sire (father) to that of their offspring. Starting from only $ and with results in 3 weeks from receipt of samples at the laboratory, dog breed identification testing checks for 1, genetic markers. Dog DNA Tests & Test Kits ; Orivet Geno Pet Dog DNA Breed Identification Test. (0). $ was $ ; Orivet Geno Pet Plus Dog DNA. Dog DNA tests aren't just a fun way to learn exactly what breeds your dog is. These tests can show important health information such as allergies. The most comprehensive panel that includes the most important tests. $£ Complete Color and Type Panel $£ A dog paternity test is carried out by comparing the DNA profiles of the dam (mother) and sire (father) to that of their offspring. You can expect the average costs of a DNA test to be anything in between $ to $ This fee is applicable if you choose to get a. An at-home pet DNA test kit with a prepaid returns box sent straight to your door—with everything you need to collect a sample, pack it up, and send it back. These profiles serve several functions, including positive identification of a dog, accurate pedigree tracking, and confirmation of parentage. There is a $10 fee to include each previously-tested profile in a new dog lineage case. The cost for testing is $38 (US) per canine ($10 to include an existing EDC Profile in a new Parentage Evaluation). DNA results are emailed within 10 business. Ancestry Pet DNA Test: Dog Breed Identification Test, Genetic Traits,DNA Matches · $ ; Breed Identification Dog DNA Test Kit Orivet Geno Pet + Breeds Free. Current Product Price List ; Tests, $ ; Tests, $ ; Tests, $ ; Tests, $ Wisdom Panel Premium · Embark Dog DNA Test (Breed + Health Kit) · DNA My Dog Breed Identification Test. Dog DNA Tests in Dog Health and Wellness(30) ; 67 · current price $ · out of 5 Stars. reviews ; 14 · current price $ · out of 5 Stars. 2.

20k Loan Requirements

If can submit or produce your proof of Income, Any bank or Financial Institution may give you any amount of loan. There is an loan criteria as. From share-secured loans to lines of credit, check out our unique loan programs for establishing and growing good credit. We offer flexibility and low rate. You should have a or higher credit score in order to qualify for a $20, personal loan. If you have bad or fair credit you may not qualify for the lowest. All personal loans have a % to % origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other. Applying for a Georgia United personal loan and getting approval is quick and convenient. Certain eligibility requirements, conditions, and exclusions. Loan amounts from $1,, · Loan terms from months · Fixed rates ranging from %% APR · Secured and unsecured loan offers. loans, certificate secured loans and home improvement loans Certain loan purposes may require higher minimum loan amounts. Call or visit. What are the requirements for a personal loan? If can submit or produce your proof of Income, Any bank or Financial Institution may give you any amount of loan. There is an loan criteria as. From share-secured loans to lines of credit, check out our unique loan programs for establishing and growing good credit. We offer flexibility and low rate. You should have a or higher credit score in order to qualify for a $20, personal loan. If you have bad or fair credit you may not qualify for the lowest. All personal loans have a % to % origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other. Applying for a Georgia United personal loan and getting approval is quick and convenient. Certain eligibility requirements, conditions, and exclusions. Loan amounts from $1,, · Loan terms from months · Fixed rates ranging from %% APR · Secured and unsecured loan offers. loans, certificate secured loans and home improvement loans Certain loan purposes may require higher minimum loan amounts. Call or visit. What are the requirements for a personal loan?

If can submit or produce your proof of Income, Any bank or Financial Institution may give you any amount of loan. There is an loan criteria as. Go online and fill out the application with required information. Select the loan amount and repayment term; Review loan details including terms and conditions. See where you stand financially. To find out whether you're ready to take on new debt, you can measure your credit status against the criteria that lenders. Credit score requirements for personal loans vary, but borrowers with higher scores may get better terms. Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs, tax returns. safeonlinereputation.ru can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. Once you decide to move forward with a certain lender, you'll verify your information and fill out a formal application. You'll need to provide the lender with. Personal loans that don't require collateral are called unsecured loans. But without collateral, the interest rate on the loan may be higher.3 Interest is a fee. Compare lenders. Different lenders have different credit score requirements. Find a co-signer. By co-signing, the other person agrees to pay back the loan if. Personal Loans are unsecured and do not require collateral like your home or other assets. How much you're able to borrow will largely depend on your credit. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for-. You're always free to make loan payments ahead, in part or in full. No collateral required. A personal loan doesn't require your home. Personal loans are considered unsecured loans because they do not require some form of collateral, such as a down payment for a mortgage or a car when taking. Maximum debt-to-income ratio: 75%, including mortgage payments. Minimum length of credit history: Two years. Minimum income requirement: None. Lender accepts. 20K 25K. Loan balance at lower interest rate. Loan balance at higher Check current rates and estimate your costs with our loan calculator. View. Use our personal loan calculator to estimate monthly payments for a Wells Fargo personal loan. 6) Fewer than 6 inquiries on your credit report in the last 6 months, not including any inquiries related to student loans, vehicle loans, or mortgages. The. Financing is subject to BECU membership, credit approval, and other underwriting criteria; not every applicant will qualify. Rates are based on an evaluation of. What is a personal loan? · What are personal loan rates and how do they work? · What can a TD Fit personal loan be used for? · What are the requirements for a TD. Personal Loans · The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of.

Meaning Of Volatility In Finance

Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. In finance volatility is a measurement of the fluctuations of the price of a security. It is essentially an analysis of the changes in the value of a. Volatility is an investment term that describes when a market or security experiences periods of unpredictable, and sometimes sharp, price movements. Stock volatility refers to the variation in a stock's price from its mean, and it can provide opportunities for investors. Volatility describes how quick and how much the price of a security or market index has changed. Volatility is linked to risk, as normally the more volatile. Unusually high spikes in volume of trading will usually correspond to volatility. Very low volume (as seen with so-called penny stocks that don't trade on major. Definition: It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by calculating the standard. Large stocks are represented by the Ibbotson® Large Company Stock Index. Downturns in this example are defined by a time period when the stock market value. Volatility refers to how quickly markets move, and it is a metric that is closely watched by traders. More volatile stocks imply a greater degree of risk and. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. In finance volatility is a measurement of the fluctuations of the price of a security. It is essentially an analysis of the changes in the value of a. Volatility is an investment term that describes when a market or security experiences periods of unpredictable, and sometimes sharp, price movements. Stock volatility refers to the variation in a stock's price from its mean, and it can provide opportunities for investors. Volatility describes how quick and how much the price of a security or market index has changed. Volatility is linked to risk, as normally the more volatile. Unusually high spikes in volume of trading will usually correspond to volatility. Very low volume (as seen with so-called penny stocks that don't trade on major. Definition: It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by calculating the standard. Large stocks are represented by the Ibbotson® Large Company Stock Index. Downturns in this example are defined by a time period when the stock market value. Volatility refers to how quickly markets move, and it is a metric that is closely watched by traders. More volatile stocks imply a greater degree of risk and.

What Does Stock Market Volatility Mean? · What is stock market volatility? Stock market volatility is a measure of how much the stock market's overall value. If you talk about the volatility of the stock market, stock prices are most likely fluctuating wildly. In chemistry, volatility means the speed with which a. The volatility of a security is the expected fluctuation of its price at any given time. The expectation is based on the asset's standard deviation from the. Volatility generally refers to a situation that is constantly changing, such as startups, mergers, acquisitions and failures in the tech world. Stock market. Volatility is a measure of the rate of fluctuations in the price of a security over time. It indicates the level of risk associated with the price changes. What is volatility? · Stock market historical trend upward · Time reduces the impact of volatility. What is volatility? Volatility is an investment term that describes when a market or security experiences periods of unpredictable, and sometimes sharp, price. In other words, if the stock market is rising and falling significantly over time, it would be called a volatile market. The significance of low vs high. Market Volatility Definition & Description. Volatility is a statistical measure that characterizes the dynamics of price movements, and the width of the. Volatile markets are characterised by extremely fast-paced price changes and high trading volume, which is seen as increasing the likelihood that the market. Volatility is the rate at which the price of a stock increases or decreases over a particular period. Higher stock price volatility often means higher risk. This definition is a measure of the potential variation in price trend, not a measure of the actual price trend. For example, two stocks could have the same. What is market volatility? Besides swings in asset prices, stock market volatility also represents the riskiness of a stock or index. The greater the volatility. Financial market volatility is defined as the rate at which the price of an asset rises, or falls, given a particular set of returns. It is often measured. That's when uncertainty among investors can drive stock market volatility, when the prices of shares swing rapidly. What you need to know about volatility. Market Volatility is the magnitude and frequency of price fluctuations in the stock market, often to gauge risk. Money in your bank account doesn't bounce around in value at all, so it has zero volatility. But that doesn't mean it's without risk—it loses value to inflation. Definition: Volatility is a mathematical measure of risk in finance. It is a measure of how much returns move, up and down, around their long-term average. Volatility is the term used to describe sudden price changes in either direction of the stock market. A high standard deviation score indicates that prices can. Market Volatility is the magnitude and frequency of price fluctuations in the stock market, often to gauge risk.

Better To Refinance Car Or Trade In

It's generally best to refinance your car loan when market rates are low and you can qualify for lower monthly payments or better terms. What to Know When Refinancing Your Car · Credit Score: Because it is possible to get auto loan financing with low credit, your score may have improved with. It comes down to either trading in your current car for a more budget-friendly car payment or refinancing your vehicle at a lower interest rate. Due to historically low interest rates the opportunity has never been better for qualified customers to refinance your auto loan. Customers with marginal credit. Instead of going out and purchasing a new or pre-owned vehicle, you can always opt to refinance your car loan. Refinancing your auto loan can often provide. refinancing, may not be worth the hassle and extra interest paid. Learn About Sometimes trading in a financed vehicle is a better option. More from. Not everyone may be happy with their auto financing, though. Fortunately, just as you can trade in a car, you can trade in your original auto loan for a better. Refinancing with cash out is simply using the equity you have in your vehicle to pay off other debts or to get extra cash for other purposes. You can generally trade in your car after refinancing. In fact, refinancing can often improve your trade-in options. iLending makes refinancing easy. It's generally best to refinance your car loan when market rates are low and you can qualify for lower monthly payments or better terms. What to Know When Refinancing Your Car · Credit Score: Because it is possible to get auto loan financing with low credit, your score may have improved with. It comes down to either trading in your current car for a more budget-friendly car payment or refinancing your vehicle at a lower interest rate. Due to historically low interest rates the opportunity has never been better for qualified customers to refinance your auto loan. Customers with marginal credit. Instead of going out and purchasing a new or pre-owned vehicle, you can always opt to refinance your car loan. Refinancing your auto loan can often provide. refinancing, may not be worth the hassle and extra interest paid. Learn About Sometimes trading in a financed vehicle is a better option. More from. Not everyone may be happy with their auto financing, though. Fortunately, just as you can trade in a car, you can trade in your original auto loan for a better. Refinancing with cash out is simply using the equity you have in your vehicle to pay off other debts or to get extra cash for other purposes. You can generally trade in your car after refinancing. In fact, refinancing can often improve your trade-in options. iLending makes refinancing easy.

Refinancing a car loan can lower your interest rate and monthly payment, adjust your repayment term, and even tap some of the equity you have in your vehicle. If you're looking to purchase a new-to-you vehicle, one easy way to decrease your monthly payments is to trade in your current vehicle. You can take the value. What to Know When Refinancing Your Car · Early Payoff Fees: Some auto loan contracts have an early loan payoff fee built into them. · Upside Down Finances: If you. Plus, in many cases, people save more money in the long run after refinancing and end up with a better monthly payment. However, many other factors play a part. You should refinance your current vehicle after 1 year of payments at minimum. Trading it in will likely make your payment go up substantially. refinance your car. On the other hand, sometimes an easy way to get a loan with better rates is just to trade your current car in for a newer one. We make. When is refinancing a car not worth it? · 1. If you plan to apply for a mortgage, credit card, or other loan · 2. If your car is old or has a lot of miles on it. Better credit. If your credit score and credit history have improved since your car loan, refinancing may provide lower interest rates. · Better interest rate. In most instances, yes, you can trade in a car with a loan, and some dealers might roll your remaining balance into a new loan. But trading in your car. If you can hold off on buying a new vehicle, you can reduce your negative equity by making extra payments on the car loan. Delaying a trade-in is often the best. Plus, in many cases, people save more money in the long run after refinancing and end up with a better monthly payment. However, many other factors play a part. Better credit. If your credit score and credit history have improved since your car loan, refinancing may provide lower interest rates. · Better interest rate. Check Your Credit Score: If you've been paying your bills on time since your vehicle was purchased, your credit score may have improved and you could benefit. Due to historically low interest rates the opportunity has never been better for qualified customers to refinance your auto loan. Customers with marginal credit. If you purchased your vehicle at a rate higher that 6 or 7%, refinancing to a lower rate can be the perfect strategy to save over the life of the payments. And. Refinance · 1. If you decide to extend your loan, you could be paying more money for interest and fees over the course of the term · 2. Refinancing an older. What to Know When Refinancing Your Car · Fees: Many loan terms have a fee for early termination, so you'll want to weigh the costs of any fee against the savings. In most cases, the earlier you're able to refinance, the better. Even a small interest rate reduction could result in significant savings over the life of the. Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long. Instead, some dealers just roll over the negative equity into your new car loan, so you still end up paying it. Example. Say you want to trade in your car for a.

1 2 3 4 5