safeonlinereputation.ru

Tools

Difference Between Refinance And Cash Out Refinance

A limited cash-out refinance allows you to add your refinancing costs to your new loan, while a no cash-out refinance pays just your current loan balance off. A cash-out refinance is a special type of refinancing vehicle that provides borrowers with a lump sum payment in exchange for a larger mortgage. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. Cash out refinancing occurs when a loan is taken out on property already owned in an amount above the cost of transaction, payoff of existing liens. The Walkers can convert a portion of their home equity into cash using a cash-out refinance. In this example, the couple can take out a new mortgage loan for. A cash-out refinance works similarly to a regular refinance except that the amount of home equity you have plays a bigger role. Lenders typically will approve a. Cash-Out Refinance Vs. Home Equity Loan. Man on phone in kitchen. The Difference Between Cash-Out Refinances And Home Equity Loans. Jul 26, 6-MINUTE READ. A cash-out refinance works the same way, but you won't likely see any savings in your monthly payments. Instead, you'll get a new home loan the covers what you. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. A limited cash-out refinance allows you to add your refinancing costs to your new loan, while a no cash-out refinance pays just your current loan balance off. A cash-out refinance is a special type of refinancing vehicle that provides borrowers with a lump sum payment in exchange for a larger mortgage. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. Cash out refinancing occurs when a loan is taken out on property already owned in an amount above the cost of transaction, payoff of existing liens. The Walkers can convert a portion of their home equity into cash using a cash-out refinance. In this example, the couple can take out a new mortgage loan for. A cash-out refinance works similarly to a regular refinance except that the amount of home equity you have plays a bigger role. Lenders typically will approve a. Cash-Out Refinance Vs. Home Equity Loan. Man on phone in kitchen. The Difference Between Cash-Out Refinances And Home Equity Loans. Jul 26, 6-MINUTE READ. A cash-out refinance works the same way, but you won't likely see any savings in your monthly payments. Instead, you'll get a new home loan the covers what you. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses.

Home equity loans can be paid back in 5, 10, and year periods, whereas cash-out refinance loans can have terms up to 30 years (like a standard mortgage). Most lenders require you to have at least 20% equity — or a loan-to-value ratio (LTV) of 80% or less — to be eligible for cash-out refinancing or a home equity. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. A mortgage cash out is a refinancing option whereby your existing mortgage balance is ultimately replaced with a higher loan balance. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. In a cash-out refinance you exchange your old mortgage for a new mortgage. This means that your interest rate and monthly payment will likely change as well. A cash-out refi works more like a traditional mortgage, where a homeowner makes monthly payments on the loan. While cash-out refinancing is an option available. Are you looking to get cash out of your home but aren't sure of the differences between a cash-out refinance vs. a home equity loan? A cash-out refi works more like a traditional mortgage, where a homeowner makes monthly payments on the loan. While cash-out refinancing is an option available. A cash-out refinance, in which you will refinance your mortgage for Borrowers with a conventional mortgage and 20% equity are not required to have PMI. A cash-out refinance is when you replace your current mortgage with a larger loan and receive the difference in cash. Two important things to remember. Cash-out mortgage vs. HELOC A home equity line of credit, or HELOC, is a second loan on top of your first one, while a cash-out refinance replaces your. A cash-out refinance loan — also known as a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in cash. While both loans leverage the value of your home, there are key differences between a HELOC and a cash-out refinance. A cash out loan is one that refinances the rate, the term or both while at the same time pulling out equity in the form of cash at the closing table. With a cash-out refinance, you exchange your existing mortgage for a new You then can receive the difference between the market value of your home. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. Rate-and-term refinancing changes the rate and/or term of your existing mortgage. It pays off your original loan and replaces it with a new mortgage. Cash out refinancing is when you take out a loan worth more than your original mortgage. You use the loan to repay the original mortgage and the remaining cash. A cash out refinance offers the advantage of potentially securing a lower interest rate compared to a home equity loan. Additionally, by refinancing your.

S&P500 Emini Fut

Real time data on the E-mini S&P Index Futures. The S&P (abbreviation of "Standard & Poor's") Index is a capitalization-weighted index of stocks. Get Live S&P Futures Rates. S&P Futures Live & updated. Other Stock Market Futures Live. Chart of S&P Futures Index. The current price of S&P E-mini Futures is 5, USD — it has risen % in the past 24 hours. Watch S&P E-mini Futures price in more detail on the. Download Table | Regular and E-mini S&P and Nasdaq futures contract information from publication: Price discovery in the E-mini futures markets: Is. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. View E-Mini S&P Future Sep | ESU24 from The Wall Street Journal. With ES futures, you can take positions on S&P performance electronically. Capitalize on the around-the-clock liquidity of E-mini S&P futures. Get the latest E-mini S&P price (ES) as well as the latest futures prices and other commodity market news at Nasdaq. The E-mini S&P index futures are the most widely traded stock index futures in the US, and provide good liquidity virtually 24 hours a day and lower trading. Real time data on the E-mini S&P Index Futures. The S&P (abbreviation of "Standard & Poor's") Index is a capitalization-weighted index of stocks. Get Live S&P Futures Rates. S&P Futures Live & updated. Other Stock Market Futures Live. Chart of S&P Futures Index. The current price of S&P E-mini Futures is 5, USD — it has risen % in the past 24 hours. Watch S&P E-mini Futures price in more detail on the. Download Table | Regular and E-mini S&P and Nasdaq futures contract information from publication: Price discovery in the E-mini futures markets: Is. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. View E-Mini S&P Future Sep | ESU24 from The Wall Street Journal. With ES futures, you can take positions on S&P performance electronically. Capitalize on the around-the-clock liquidity of E-mini S&P futures. Get the latest E-mini S&P price (ES) as well as the latest futures prices and other commodity market news at Nasdaq. The E-mini S&P index futures are the most widely traded stock index futures in the US, and provide good liquidity virtually 24 hours a day and lower trading.

View E-Mini S&P Future Sep | ESU24 from The Wall Street Journal. Get S&P Fut (Dec'24) (@SPCME:Index and Options Market) real-time stock quotes, news, price and financial information from CNBC. Learn the basics of E-Mini S&P futures and weekly options. Understand their mechanics and benefits. Call today () to learn more! e-mini S&P futures contract x RATIO x USDCZK. The underlying changes monthly or quarterly, as shortly before the future expires there is a roll-over in the. Index performance for S&P EMINI FUT Dec24 (ESA) including value, chart, profile & other market data. E-Mini Nasdaq Index Futures Contract Specifications. The E-mini Nasdaq index futures contracts are standardized exchange-traded contracts that represent. The large S&P future (ticker: SP) has a contract size of USD per point and thus has 5 times the value of the E-mini future. The contract is therefore. S&P futures S&P Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the S&P. Live E-Mini S&P Futures chart. Plus all major currency pairs, realtime Indices Charts, Commodities Charts, Futures Charts and more. This derivative allows an investor to trade today the future price expectation for the stock portfolio represented by the S&P Index - one of the most. Today's S&P E-Mini prices with latest S&P E-Mini charts, news and S&P E-Mini futures quotes. (+%). Summary · News · Chart · Historical Data · Futures. CME - Delayed Quote • USD. E-Mini S&P Sep 24 (ES=F). Follow. 5, + (+%). The most popular US stock index futures contract is the E-mini S&P futures contract, which is traded at the CME Group. ESU24 | A complete E-Mini S&P Future Sep futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Emini S&P futures are one-fifth the value of the big S&P futures contract, whose value is arrived at by multiplying the S&P 's value by USD E-mini S&P futures are a mini version (1/5 th the size) of S&P futures contracts and are traded on the CME. Get E-mini S&P (ES) historical prices as well as the latest futures prices and other commodity market news at Nasdaq. futures, where all traders see the same prices and quotes. CME Micro E-mini Equity Index Futures Contracts. Micro E-mini S&P Futures and Options. Trade. What are Micro S&P Futures Doing Right Now? Micro S&P Futures are trading at 5, What are Index Futures? Index futures are financial contracts. Complete E-Mini S&P Future Dec futures overview by Barron's. View the ESZ25 futures and commodity market news with real-time price data for.

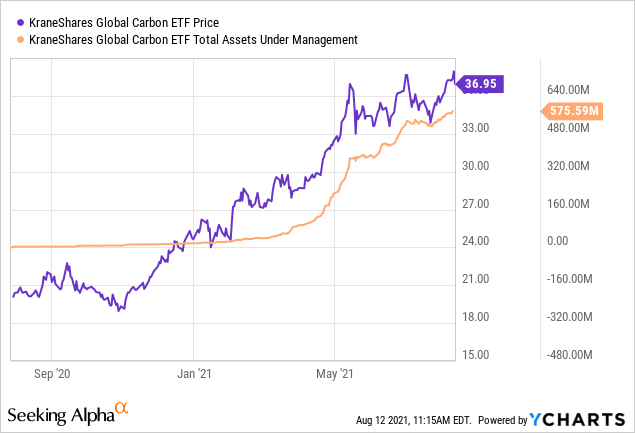

Krbn Stock Price

KRBN ETF FAQ · What was KRBN's price range in the past 12 months? KRBN lowest ETF price was $ and its highest was $ in the past 12 months. · What is. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Open An Account. View Disclosure. 2. Gemini · logo. Daily Performance ; NAV, $ ; NAV Daily Change, % ; Market Price, $ ; Market Price Daily Change, % ; 30 Day Median Bid/Ask Spread, %. Notes & Data Providers. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading. Latest KraneShares Global Carbon Strategy ETF (KRBN) stock price, holdings, dividend yield, charts and performance. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may. Distribution History KRBN. DATE, INCOME DISTRIBUTION. , $ , $ , $ , -. Overview. Notes & Data Providers. Stocks: Real-time U.S. (KRBN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. KRBN - KraneShares Global Carbon ETF. NYSEArca - Nasdaq Real Time Price. Currency in USD. + (+%). As of August 27 PM EDT. Market open. Red. KRBN ETF FAQ · What was KRBN's price range in the past 12 months? KRBN lowest ETF price was $ and its highest was $ in the past 12 months. · What is. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Open An Account. View Disclosure. 2. Gemini · logo. Daily Performance ; NAV, $ ; NAV Daily Change, % ; Market Price, $ ; Market Price Daily Change, % ; 30 Day Median Bid/Ask Spread, %. Notes & Data Providers. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading. Latest KraneShares Global Carbon Strategy ETF (KRBN) stock price, holdings, dividend yield, charts and performance. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may. Distribution History KRBN. DATE, INCOME DISTRIBUTION. , $ , $ , $ , -. Overview. Notes & Data Providers. Stocks: Real-time U.S. (KRBN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. KRBN - KraneShares Global Carbon ETF. NYSEArca - Nasdaq Real Time Price. Currency in USD. + (+%). As of August 27 PM EDT. Market open. Red.

; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range

KraneShares Trust - KraneShares Global Carbon Strategy ETF (NYSEMKT: KRBN) ; OTC: OTCM. OTC Markets Group. OTC Markets Group Stock Quote ; NASDAQ: PRAA. PRA Group. Check if KRBN Stock has a Buy or Sell Evaluation. KRBN ETF Price (NYSEARCA), Forecast, Predictions, Stock Analysis and KFA Global Carbon News. KraneShares Global Carbo stock quote and KRBN charts. Latest stock price today and the US' most active stock market forums. Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing Quantitative Ratios. Stock Ratios Locked. You. KraneShares Global Carbon ETF KRBN:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/30/23 · 52 Week Low. The share price as of August 14, is / share. Previously, on August 15, , the share price was / share. This represents a decline of %. KRBN - KraneShares Global Carbon Strategy ETF - Stock screener for investors and traders, financial visualizations. Get the latest news of KRBN from safeonlinereputation.ru Our Research, Your Success. Certain Zacks Rank stocks for which no month-end price was available, pricing. What is Kraneshares Global Carbon Strategy ETF stock price doing today? As of May 17, , KRBN stock price declined to $ with 55, million shares. KRBN Historical Prices ; , , , ; , , , Learn everything about KraneShares Global Carbon Strategy ETF (KRBN). News, analyses, holdings, benchmarks, and quotes. Find the latest quotes for KraneShares Global Carbon Strategy ETF (KRBN) as well as ETF details, charts and news at safeonlinereputation.ru An easy way to get KraneShares Global Carbon Strategy ETF real-time prices. View live KRBN stock fund chart, financials, and market news. KRBN ETF Stock Price History ; Jul 29, , , , , ; Jul 28, , , , , KFA Global Carbon ETF (KRBN): Price and Financial Metrics ETF · KFA Global Carbon ETF (KRBN): $ · Get Rating · Component Grades. KraneShares Global Carbon ETF (KRBN) Find here information about the KFA Global Carbon ETF (KRBN). Assess the KRBN stock price quote today as well as the. Shares. Market Price. $ Commissions. $ Estimated Cost. $ Sign up for a Robinhood brokerage account to buy or sell KRBN stock and options. Looking to buy KRBN ETF? View today's KRBN ETF price, trade commission KRBN Stock News. View all · An Advisor's Guide to Carbon Allowance. The current KraneShares Global Carbon ETF [KRBN] share price is $ The Score for KRBN is 51, which is 2% above its historic median score of 50, and infers. Explore KRBN for FREE on ETF Database: Price, Holdings, Charts, Technicals Stock Profile & Price. KRBN Stock Profile & Price; Dividend & Valuation.

Daily Market Report

Market statistics, market quality information, and program trading reports are all issued regularly for each of NYSE's markets. Market Data. Statistics. Derivatives Market · Daily Market Report (Archive). Daily Market Report (Archive). Derivatives Market. Navigation Icon. Read the latest on the stock and option markets by Hammerstone Markets, directly on Investrade's website. Daily market reports are posted here 3 times per. Daily Stock Market News. Markus Heitkoetter. (43); INVESTING report bombshell - brace for impact - Unemployment shocker - labor market shifting gears? Our market analysts keep you updated on the latest market trends including stock market data, news, market activity, and economic reports in the daily stock. The reports give farmers, producers and other agricultural businesses the information they need to evaluate market conditions, identify trends, make purchasing. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. A look at the day ahead in U.S. and global markets from Mike Dolan. Markets Reuters Diversity Report, opens new tab. Stay Informed. Download the App. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Market statistics, market quality information, and program trading reports are all issued regularly for each of NYSE's markets. Market Data. Statistics. Derivatives Market · Daily Market Report (Archive). Daily Market Report (Archive). Derivatives Market. Navigation Icon. Read the latest on the stock and option markets by Hammerstone Markets, directly on Investrade's website. Daily market reports are posted here 3 times per. Daily Stock Market News. Markus Heitkoetter. (43); INVESTING report bombshell - brace for impact - Unemployment shocker - labor market shifting gears? Our market analysts keep you updated on the latest market trends including stock market data, news, market activity, and economic reports in the daily stock. The reports give farmers, producers and other agricultural businesses the information they need to evaluate market conditions, identify trends, make purchasing. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. A look at the day ahead in U.S. and global markets from Mike Dolan. Markets Reuters Diversity Report, opens new tab. Stay Informed. Download the App. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more.

Stocks Up for 5th Day on Jumbo Rate Cut Hopes Stocks rallied again and yields hit new week lows on growing hopes for a basis-point Fed rate cut. Info. Livestock, Poultry & Grain · Breadcrumb · Download new Market News Mobile App · Resources · Historical Data · Reports by Commodity · Cattle · Additional Resources. 10 Day Moving Average ; FINRA/NYSE TRF, 54,,, % ; FINRA/Nasdaq TRF™ Chicago, 6,,, % ; Total, 3,,,, %. Keep your business in the know with all the latest energy news, insights, trends, and analysis. Our daily market updates provide you with a comprehensive. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. The latest news and updates on the stock market today. Get up to speed with overnight summaries, stock market updates, and pre-open stock analysis of the. The Boom in Zero-Day Options Is Coming for Tesla and Nvidia WSJ Opinion: Business Backs Away From DEI · Journal Editorial Report: Corporations are dropping. Schwab's take on the markets offers an information-packed summary of each trading day's key results and statistics for investors. (Sharecast News) - European shares finished higher on Friday as the betting increased on a larger-than-expected US interest rate cut in US, a day after the. reports this week. Elsewhere, traders monitored political developments Daily. Market Data Coverage: United States. Related. US Year Yield Slips as. Find the latest stock market news from every corner of the globe at safeonlinereputation.ru, your online source for breaking international market and finance news. Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Every weekday, RFD-TV's “Market Day Report” delivers live coverage of agri-business news, weather, and commodity market information from across the world. Daily market summary represents volume from all trading venues on which Nasdaq® Issues are traded. For Sep 12, Share Volume, Dollar Volume. Total Volume. Daily Market Report | 01/03/ Daily Market Report | 01/03/ US FINANCIAL MARKET Bonds Bounce Off Lows, Stocks Drop Deepens on Data: Markets [ ]. Daily Market Report (Latest) ; bluepoint, Currency Options ; bluepoint, CNH London Aluminium Mini Futures ; bluepoint, CNH London Zinc Mini Futures ; bluepoint, CNH. Market Rollercoaster: Today's CPI Inflation Report Shocks Traders. Want my New Audio Book, Building Your Financial Fortress? Get it here: safeonlinereputation.ru Morningstar Global Markets. Market Barometers. 1 Day. 1 Month. 3 Months. 1 Year. 5 Plus, new research on Nvidia and market valuations today. David Sekera. This dataset tracks the daily buying and selling activity of retail investors at the ticker level. With Retail Trading Activity Tracker, you can see the most. Daily Market Reports · Historical Reports · Forms & Formats · Business Growth Reports for. Search a Report: Select All Reports Multiple file Download. Reports.

First Time Driver Over 25 Insurance

Black box or telematics insurance can often be appropriate for very young drivers. But it could help to reduce premiums for over 25s, too. Taking out a higher. Tesla Real-Time Insurance uses specific features within Tesla vehicles and Safety Factors to evaluate your driving behavior and premium. When you first sign up. Full coverage car insurance for 25 year olds is $2, per year on average, 23 percent higher than the national average annual premium of $2, Over time, as both genders build their driving records, other insurance underwriting factors come into play. “When the daughter turns 21, assuming she has a. I am looking to get a car soon, but I've heard that car insurance can be super high for new drivers due to lack of driving history. Although there's no specific answer, to most insurance companies, young drivers would typically include anyone who falls into the 16–year-old category. Experienced drivers are less likely to have accident claims, which means they cost less to insure. At Progressive, the average premium per driver tends to. Lacking experience as a new driver · Risk-taking behaviour being more common among younger drivers e.g. speeding or driving under the influence · Peer pressure. The best car insurance for new drivers under 25 years old is from companies like Allstate, Geico, Progressive, and Safeco. They are among the cheapest car. Black box or telematics insurance can often be appropriate for very young drivers. But it could help to reduce premiums for over 25s, too. Taking out a higher. Tesla Real-Time Insurance uses specific features within Tesla vehicles and Safety Factors to evaluate your driving behavior and premium. When you first sign up. Full coverage car insurance for 25 year olds is $2, per year on average, 23 percent higher than the national average annual premium of $2, Over time, as both genders build their driving records, other insurance underwriting factors come into play. “When the daughter turns 21, assuming she has a. I am looking to get a car soon, but I've heard that car insurance can be super high for new drivers due to lack of driving history. Although there's no specific answer, to most insurance companies, young drivers would typically include anyone who falls into the 16–year-old category. Experienced drivers are less likely to have accident claims, which means they cost less to insure. At Progressive, the average premium per driver tends to. Lacking experience as a new driver · Risk-taking behaviour being more common among younger drivers e.g. speeding or driving under the influence · Peer pressure. The best car insurance for new drivers under 25 years old is from companies like Allstate, Geico, Progressive, and Safeco. They are among the cheapest car.

Car insurance tends to be more expensive for new drivers because they are more likely to be involved in accidents than drivers over the age of And they. Getting auto insurance as a new driver can be expensive. Insurers charge higher rates because you're more likely to be in an accident due to inexperience. coverage may cost more than the car is worth. If you have a sports car or a high performance car you may have a hard time finding insurance at standard rates. For the coach: Even after your new driver obtains his/her provisional license, please . • If you are over 25 and have additional questions, please go to www. Yes, as a young driver you can get affordable car insurance, even if you're under the age of Age alone doesn't determine car insurance premiums. There are. Full coverage car insurance for 25 year olds is $2, per year on average, 23 percent higher than the national average annual premium of $2, If you're a new driver, you'll have no driving record for insurers to assess you by so your quote will depend mostly on your age, gender, the area you live in. For the youngest new drivers between the ages of , annual insurance premiums average around £1, and while car insurance for years old isn't as. The cost of car insurance for a first-time driver can be eye-opening, as it's typically higher due to the perceived risk associated with. It's definitely a good idea to include it if the cash value of your car is more than your premium. Picking the adequate vehicle for a first time driver is. While rates typically decrease as teen drivers gain experience and reach milestones like turning 25, individual circumstances vary. Factors like driving record. Car insurance for teens and new drivers Learning to drive is an exciting time for a teenager. But it can also be expensive. Fortunately, State Farm® offers. Good student: save up to 25% for good grades; Safe driver: no at-fault Upset woman near her car after an accident. How much car insurance do I need. Car insurance for new drivers, who get their license at 16, tends to go down after five years when they turn The real cost savings come at 25 and 30, though. Your teen getting their license is a milestone—for them and for your insurance. Until your new driver gains experience on the road, having them on your. The cheapest car insurance companies for drivers younger than 25 include COUNTRY Financial, Auto-Owners, and USAA. All three companies offer liability rates. Drivers who have been convicted of a DWI. For a first offense, the driver must provide proof of insurance for three years after the date of the conviction. For. Whether you are looking for a better price on auto insurance for your family or are helping your new driver purchase their first car, AAA offers everything. New driver car insurance is a type of coverage intended for people who are new to the country or province. They can also be new to driving - typically mature. Husband and wife driving off in a convertible car after getting married. You Once you've added your new driver, take a few minutes to talk to your.

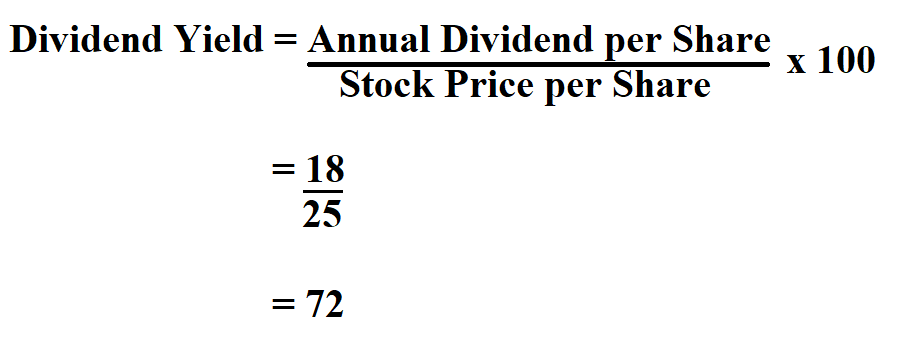

How To Find The Yield Of A Stock

Dividend Yield = Annual dividends per share ÷ average share price at time of purchase. The dividend yield formula is calculated by dividing the annual dividends per share by the price per share. It helps companies know what exactly they need to. The percent yield formula is a way of calculating the annual income-only return on an investment by placing income in the numerator and cost (or market value). Current Yield = Annual Dividend / Current Share Price If cash dividend is paid monthly, say $ / month = 12 x $ = $ Annual. 1. Find the amount paid in dividends in total, and add to that the amount paid towards share repurchases. · 2. Subtract the value of shares issued from this sum. The dividend yield is the annual dividend per share divided by the current stock price, expressed as a percentage. The dividend growth rate is the annual. Dividend Yield is calculated by multiplying the dividend amount by distribution frequency, divided by share price at the start of the year. Want to know how much cash flow you're getting for every dollar you've invested in a company? For companies that pay dividends, the Dividend Yield can give. Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. This number tells you what you can. Dividend Yield = Annual dividends per share ÷ average share price at time of purchase. The dividend yield formula is calculated by dividing the annual dividends per share by the price per share. It helps companies know what exactly they need to. The percent yield formula is a way of calculating the annual income-only return on an investment by placing income in the numerator and cost (or market value). Current Yield = Annual Dividend / Current Share Price If cash dividend is paid monthly, say $ / month = 12 x $ = $ Annual. 1. Find the amount paid in dividends in total, and add to that the amount paid towards share repurchases. · 2. Subtract the value of shares issued from this sum. The dividend yield is the annual dividend per share divided by the current stock price, expressed as a percentage. The dividend growth rate is the annual. Dividend Yield is calculated by multiplying the dividend amount by distribution frequency, divided by share price at the start of the year. Want to know how much cash flow you're getting for every dollar you've invested in a company? For companies that pay dividends, the Dividend Yield can give. Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. This number tells you what you can.

Yield is a measurement to describe how profitable an investment is. The formula examines an arbitrary time period – usually a period of one year. The formula to. What is Dividend Yield? · Dividend Yield = Dividend per share / Market value per share · Dividend Yield Ratio = ($ + $ + $ + $) / $45 = A yield measures any income from an investment over a set period of time, such as dividends from shares or interest from bonds. A yield is an important metric. With gross dividends distributed, you can find the per-share dividend by dividing the total dividend payments by the total weighted-average number of shares. Percent Yield Formula · = Dividends per Share / Stock Price x · = Coupon / Bond Price x · = Net Rental Income / Real Estate Value x Yield on cost is an investment's annual dividend divided by the original purchase price of the investment. It's the dividend as a percentage of how much you. To calculate a stock's current yield, take the most recent quarter's per share distribution and multiply it by four. that represents the projected annualized. Answer and Explanation: 1. The answer is%. You know the dividend is $ and the closing price is $ from the question. Now you can calculate the. Earnings Yield is earnings divided by price. It is expressed as a percentage of the investment value and is the reciprocal of the P/E Ratio. Want to know how much cash flow you're getting for every dollar you've invested in a company? For companies that pay dividends, the Dividend Yield can give. Stock yield measures the growth of an investment. It is a popular method among value investors, who look for stocks with strong growth potential. There are two. How to calculate dividend yield · Investors can multiply the most recent quarterly dividend by four, then divide that number by the latest stock price. Yield is used to describe the annual return on your investments as a percentage of your original investment, usually from either: Dividend payments from a stock. How is dividend yield calculated? By dividing the annual dividend per share by the price per share, then multiplying the result by Dividend Yield = Annual. Earnings Yield = % * (earnings per share / market price per share). Earnings Yield = % * (1 / PE ratio). Calculating the Earnings Yield, An Example. Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How To Calculate Dividend. The dividend yield is calculated using the annual yield (every regular payout paid that year). It is not calculated by using quarterly, semi annual or monthly. calculating yield on price for user-defined securities. calculating yield for fixed- income securities, and. calculating the yield for a portfolio. The formula for calculating the dividend yield is DY = Annual DPS ÷ Stock Price. What Is Dividend Yield? How To Calculate; Dividend Yield vs. Dividend. In that case, the dividend yield of the stock will be 10/* = 10%. High dividend yield stocks are good investment options during volatile times, as these.

Is This Right Time To Invest In Stocks

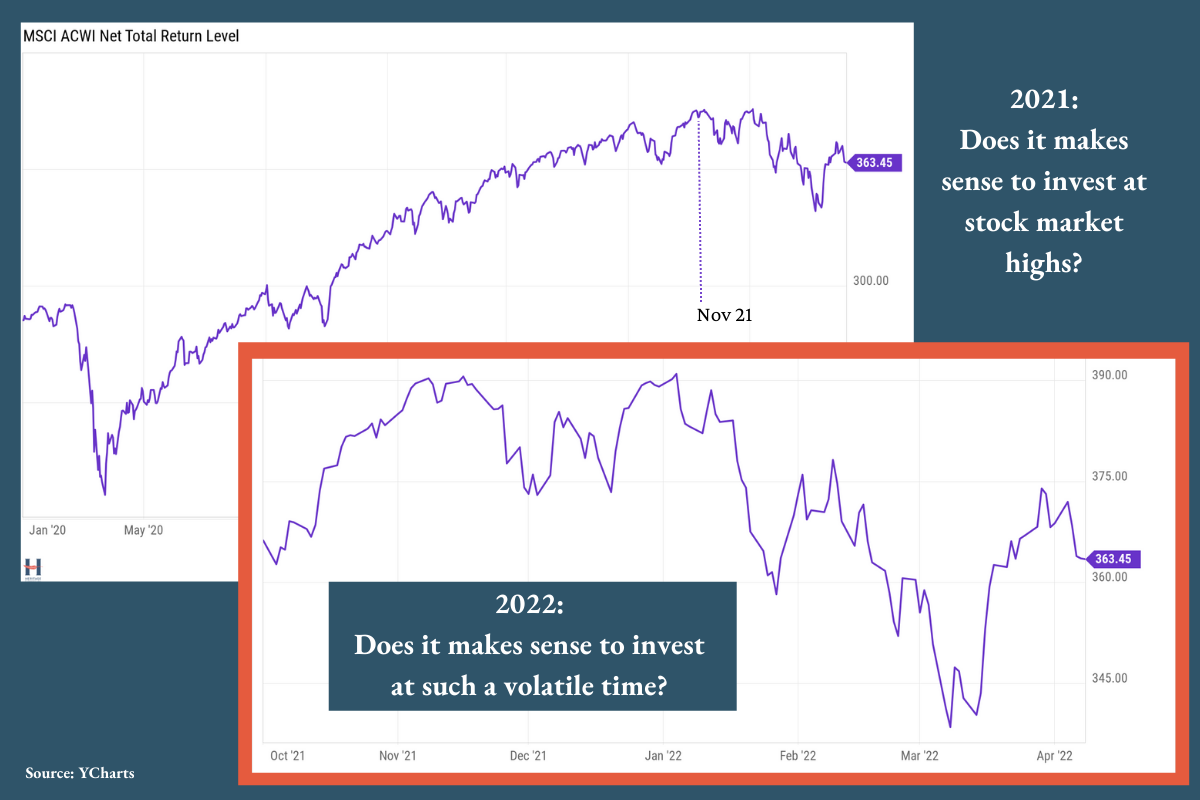

With the S&P index down approximately 20% from its record highs, this is a good time to consider investing in stocks. When I point this out, clients ask the. Therefore, sitting on cash or redeeming all your equity investments just because the stock market is setting new highs are not good ideas. Nevertheless, this. Historically, investors have experienced better results by staying invested in the stock market rather than trying to time it. Investing is all about playing the long game – that's at least five years, but ideally a lot longer. Taking a long-term approach with your investments helps cut. Time in the market beats timing the market. The best moment to buy stocks is always yesterday. I believe there are two big reasons for October being thought of as a poor time to buy stocks. right time to invest. Maybe because stocks are too high or they. We expect solid returns from both stocks and bonds over the next six to 12 months. Once again, a multi-asset investment portfolio can work in different economic. Many people interested in trading stocks wonder if there are any rules about when to buy or sell stocks. While some vague timing guidelines do exist. Explore factors determining the right time to invest in stocks. Gain insights for strategic decision-making in the dynamic financial market. With the S&P index down approximately 20% from its record highs, this is a good time to consider investing in stocks. When I point this out, clients ask the. Therefore, sitting on cash or redeeming all your equity investments just because the stock market is setting new highs are not good ideas. Nevertheless, this. Historically, investors have experienced better results by staying invested in the stock market rather than trying to time it. Investing is all about playing the long game – that's at least five years, but ideally a lot longer. Taking a long-term approach with your investments helps cut. Time in the market beats timing the market. The best moment to buy stocks is always yesterday. I believe there are two big reasons for October being thought of as a poor time to buy stocks. right time to invest. Maybe because stocks are too high or they. We expect solid returns from both stocks and bonds over the next six to 12 months. Once again, a multi-asset investment portfolio can work in different economic. Many people interested in trading stocks wonder if there are any rules about when to buy or sell stocks. While some vague timing guidelines do exist. Explore factors determining the right time to invest in stocks. Gain insights for strategic decision-making in the dynamic financial market.

By picking the right group of investments You'll be exposed to significant investment risk if you invest heavily in shares of your employer's stock or any. Whether you're new to investing or with years of stock market experience, hand-picking individual company shares with long-term potential isn't a walk in the. This is the best time to invest in the stock market, if you are looking to buy for the long term and after considering all the above factors. Common stock entitles owners to vote at shareholder meetings and receive dividends. Preferred Stocks Preferred stockholders usually don't have voting rights but. If Monday may be the best day of the week to buy stocks, then Thursday or early Friday may be the best day to sell stock—before prices dip. If you're interested. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. You should be prepared to invest for at least 5 years to give you a chance to ride out any short-term fluctuations. Historically, markets tend to rise over time. There is no right time to invest. To succeed in your investments, it's stock market investment always pays off. Invest as early as possible. There. Stocks can be particularly appealing to younger investors for a number of reasons. For one, you have more time to recoup potential losses. This article from. Time in the stock market is better than timing the stock market. · Trying to time the market is difficult for even the savviest investors. · Consider your time. The best time to invest in share market is when the market is falling as you can get a share at lower price and sell the shares when the market. Investors should create a strategy for buying, holding, or selling a stock that considers their risk tolerance and time horizon. Investors might sell their. If you're thinking about investing, using a stocks and shares ISA may be a good place to start time of publishing. We do not provide any personal. While it's generally safe to invest at any time (even during bear markets), there are a couple of situations where it could be risky. Stocks can be a valuable part of your investment portfolio. Owning stocks in different companies can help you build your savings, protect your money from. Dividend stocks are popular among older investors because they produce a regular income, and the best stocks grow that dividend over time, so you can earn more. Some experts suggest to start investing now, rather than waiting for the market to bottom. Picking the bottom would be difficult. The reason for this is that all significant market news for the day is factored into the stock price first thing in the morning. So, when it comes to trading. This is the best time to invest in the stock market, if you are looking to buy for the long term and after considering all the above factors. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that.

How To Dispute A Collection On My Credit Report

How can you remove collections from a credit report? · Step 1: Ask for proof · Step 2: Dispute inaccurate collections · Step 3: Ask for a pay-for-delete agreement. How do I dispute a debt that is not mine on my credit report? Tell the credit reporting company, in writing, what information you think is inaccurate. Include. If you believe any item in your Equifax credit report is incomplete or inaccurate, you can begin the dispute process by creating or signing your myEquifax. It could keep the debt off your credit report. Once you dispute a debt, the debt collector has to cease all collection activity and cannot report it to the. If you dispute the legitimacy of something in your debt collector's file, you must give the collector written notice. Simply calling the collector won't cease. Check your credit report for errors · Gather your proof · Write a dispute letter · Wait for a response · Keep an eye out for changes to your score and report. Instead you send a notice of dispute to the credit bureau (TransUnion, Equifax) who contacts the creditor for evidence on your behalf. Reply. Step 1- Dispute the debt with both the creditor and the consumer reporting agency (CRA). Disputing a debt directly with the creditor may resolve the issue, but. If the debt collector has already reported the debt (before it received your dispute letter), it must notify the credit reporting agencies that the debt is. How can you remove collections from a credit report? · Step 1: Ask for proof · Step 2: Dispute inaccurate collections · Step 3: Ask for a pay-for-delete agreement. How do I dispute a debt that is not mine on my credit report? Tell the credit reporting company, in writing, what information you think is inaccurate. Include. If you believe any item in your Equifax credit report is incomplete or inaccurate, you can begin the dispute process by creating or signing your myEquifax. It could keep the debt off your credit report. Once you dispute a debt, the debt collector has to cease all collection activity and cannot report it to the. If you dispute the legitimacy of something in your debt collector's file, you must give the collector written notice. Simply calling the collector won't cease. Check your credit report for errors · Gather your proof · Write a dispute letter · Wait for a response · Keep an eye out for changes to your score and report. Instead you send a notice of dispute to the credit bureau (TransUnion, Equifax) who contacts the creditor for evidence on your behalf. Reply. Step 1- Dispute the debt with both the creditor and the consumer reporting agency (CRA). Disputing a debt directly with the creditor may resolve the issue, but. If the debt collector has already reported the debt (before it received your dispute letter), it must notify the credit reporting agencies that the debt is.

Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. It's possible to remove a collection account from your credit report by disputing an inaccurate account or requesting deletion for an account that is being or. Disputing Collections on Your Credit Report · Review your credit report: Start by obtaining a copy of your credit report from all three major credit bureaus. First, write the collection agency within 30 days of receiving the first notice, informing them that you dispute the debt and why. Make sure your letter is. You may be able to ask the collection agency, the original creditor or both to request the credit bureaus delete the delinquency from your credit reports as a. Has there been no payments made on the time share whatsoever for the last 8 years? If that is the case, send written disputes to the credit reporting agencies. You also can take your complaints to those responsible for supplying information to the credit bureaus: banks, retailers, mortgage companies — in short, anyone. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. Ask the credit reporting agency for a dispute form or submit your dispute in writing along with copies of any supporting documents. Keep a copy of what you send. How can you remove collections from a credit report? · Step 1: Ask for proof · Step 2: Dispute inaccurate collections · Step 3: Ask for a pay-for-delete agreement. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you. reported it, please contact the credit reporting agencies, inform them that the debt is disputed, and ask them to delete it from my credit report. Reporting. In this guide, we'll outline valid reasons to contest those stubborn collections and provide the scrubbing tools to help remove them from your record. If you are disputing inaccurate information on your credit report, you can send a written notice to the furnisher, which should provide a mailing address. A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. If you have already reported it, please notify the credit reporting agencies that the debt is disputed and/or delete the tradeline from my credit report. You can write to the credit bureaus to ask them to fix any inaccurate information on your credit report. You can find instructions for how to dispute incorrect. Fixing credit report errors · Clearly identify each disputed item in your report. · State the facts and explain why you dispute the information. · Request deletion. Disputing and Removing Incorrect Collections from Your Credit Report · 1. Review all of your credit reports. · 2. File a dispute with the credit bureau. · 3. File.

1 2 3 4 5