safeonlinereputation.ru

Gainers & Losers

Do Taxes Go Up When You Refinance

You can improve your property before cash-out refinancing to increase its value. However, if your property gets a pretty higher market value after an appraisal. If you do, your loan amount will increase. (negatively amortize), and, as a You must directly pay your property costs, such as taxes and homeowner's insurance. Will refinancing lead to a reassessment? Maybe. Often times, the initial transfer effected for the purpose of refinancing, whereby a name is placed on or taken. Refinancing your mortgage can allow you to change the term of your current mortgage to pay it off faster or lower your monthly payment. Any change in ownership may reset the assessed value of the property to full market value, which could result in higher property taxes. Transferring & Refinancing Property. If you are transferring (i.e., selling) your property and your tax bill is unpaid at the time of settlement, taxes will be. In short, no. California property taxes are not reassessed when a homeowner refinances his or her mortgage. And the simple reason for this is. While no one was glad to see high mortgage rates in , it's also true that those higher mortgage rates can make the mortgage interest deduction more valuable. If your refinance is closing after October 1, but before December 10, your property taxes need to be paid at closing since they are “due.” Keep in mind that. You can improve your property before cash-out refinancing to increase its value. However, if your property gets a pretty higher market value after an appraisal. If you do, your loan amount will increase. (negatively amortize), and, as a You must directly pay your property costs, such as taxes and homeowner's insurance. Will refinancing lead to a reassessment? Maybe. Often times, the initial transfer effected for the purpose of refinancing, whereby a name is placed on or taken. Refinancing your mortgage can allow you to change the term of your current mortgage to pay it off faster or lower your monthly payment. Any change in ownership may reset the assessed value of the property to full market value, which could result in higher property taxes. Transferring & Refinancing Property. If you are transferring (i.e., selling) your property and your tax bill is unpaid at the time of settlement, taxes will be. In short, no. California property taxes are not reassessed when a homeowner refinances his or her mortgage. And the simple reason for this is. While no one was glad to see high mortgage rates in , it's also true that those higher mortgage rates can make the mortgage interest deduction more valuable. If your refinance is closing after October 1, but before December 10, your property taxes need to be paid at closing since they are “due.” Keep in mind that.

Changes of ownership may or may not affect your property taxes depending on whether the conveyance is considered a transfer of ownership. And, the increased loan balance of a cash-out refinance does not increase your taxable basis. That is, even with a new $1,, loan on the above property. To meet future taxes and insurance costs, you will then be required to Will I be asked to refinance my Rural. Development Loan? The goal of our. Some years you may not qualify, and as a result, you may notice an increase in your monthly mortgage payments. Can my monthly mortgage payment go down? Yes —. No, the cash you receive from a cash out refinance isn't taxed. That's because the IRS considers the money a loan you must pay back rather than income. The good news is no. The IRS doesn't generally consider loans, even mortgage refinance loans, as income because the expectation is that you will pay the money. 4. What is a Revaluation? Revaluations are performed periodically to assure that the burden of tax is distributed equitably and uniformly among property owners. you pay for local benefits that tend to increase the value of your property. up to the amount of your old mortgage principal just before the refinancing. For example, your residential property is under the Class 1 tax rate, which is $ If your house is assessed at $,, divide $, by ; that amount. Because the taxes are based on the Taxable Value, even with a decrease in the SEV, the taxes could still go up. If I refinance my home, will it “uncap”? (show. However, refinancing a rental property to pull cash out does have an impact on the financial performance of an investment and on the pre-tax income the property. When you refinance, you essentially skip two months of mortgage payments. That's two months' worth of payments that can easily go towards taxes! In fact, with a. Also, if a homeowner is refinancing a mortgage for a second time, the balance of points paid for the first refinanced mortgage may be fully deductible at pay. Be sure to understand how your home will be taxed and how those taxes could increase and affect your homebuying budget. Where Can I Find More Informa on? See. Lenders want to make sure that your property is insured and that the taxes are paid on time, reducing the risk to the bank that you will default on the loan or. No, it will not affect your taxes. The appraiser does not report the appraised value or anything they see in the home (eg, illegal decks or additions. When should you file a Property Transfer Tax Return? Transfer by Deed: A What types of non-principal residences are taxed at a higher rate? A. Do I qualify for the semi-annual tax payment plan, and if so, how do I sign-up? do not require that property taxes must be paid if you refinance your mortgage. higher than the previously assessed Proposition 13 adjusted base year value will increase the property taxes. Conversely, if the current market value is. I received a tax increase due to a Board of Review or Michigan Tax Tribunal appeal. Who do I need to contact regarding my new tax amount? If you were granted a.

What Is Better Investment

When you don't need to access your money soon but still want to avoid the risk of investing in the stock market, a government bond could be a good fit. Here are. Powering Better Portfolios through Technology and Data. MSCI offers clients mission-critical data and technology capabilities focused on quality, reliability. On the flip side, real estate investment provides cash flow, depreciation, appreciation, and tax benefits. Stock market doesn't do that. Find. Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend. If you are a high-income earner, a Backdoor Roth IRA may be a good retirement investment option for you. Learn what it is and how to set up this type of. Under the right circumstances, real estate can be an alternative to stocks, offering lower risk, yielding better returns, and providing greater diversification. Savings accounts, even the best high-yield ones, offer a relatively low return compared to investment accounts — sometimes even lower than the rate of inflation. Under the right circumstances, real estate can be an alternative to stocks, offering lower risk, yielding better returns, and providing greater diversification. When you don't need to access your money soon but still want to avoid the risk of investing in the stock market, a government bond could be a good fit. Here are. Powering Better Portfolios through Technology and Data. MSCI offers clients mission-critical data and technology capabilities focused on quality, reliability. On the flip side, real estate investment provides cash flow, depreciation, appreciation, and tax benefits. Stock market doesn't do that. Find. Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend. If you are a high-income earner, a Backdoor Roth IRA may be a good retirement investment option for you. Learn what it is and how to set up this type of. Under the right circumstances, real estate can be an alternative to stocks, offering lower risk, yielding better returns, and providing greater diversification. Savings accounts, even the best high-yield ones, offer a relatively low return compared to investment accounts — sometimes even lower than the rate of inflation. Under the right circumstances, real estate can be an alternative to stocks, offering lower risk, yielding better returns, and providing greater diversification.

Inflation reduces how much you can buy because the cost of goods and services rises over time. Equities offer two key weapons in the battle against inflation. Creating an investment portfolio is one simple⎯ and practical⎯ option to help grow your funds. So, which types of investments are best for you: Stocks vs. Mutual funds can provide access to many different parts of the market, even within the broad asset classes of stocks and bonds. Within stocks you can invest in. Mutual Funds are the best investment options with high returns that allow multiple investors to pool money and invest in a diversified portfolio of market-. Both have their pros and cons. Real Estate: Tangible Asset. Requires a 20% down payment for an Investment Property + Closing Costs. BetterInvesting is a nonprofit organization that has helped over 5M people learn how to invest profitably in stocks of high-quality growth companies. Best Investment Apps · Best Stock Trading Apps · Best Online Brokers · Best Real Estate Investing Apps · Best Robo-Advisors · Best Online Financial Advisors · Best. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. In this article, I'll explain the similarities and differences between Fidelity Investments, Charles Schwab Corporation and The Vanguard Group. A good rule of thumb for that is the 4% Rule. You could use multiple assets such as dividend-paying stocks, bonds and real estate among others to create a. According to a Gallup poll published in May, 34% of Americans believe that real estate is the best long-term investment, while only 18% say that stocks or. Any good investment has a high chance of success and a solid return on your investment. One of the factors in favor of real estate investing is the relatively. In conclusion. It's worth noting you don't actually have to choose between stocks and property. You can actually invest in property on the stock market with. If renting to families, perhaps a common commuter belt or being near good schools and nice outside spaces might come into play, while renting to students will. What is passive investing? Passive investing, sometimes called buy-and-hold, is a popular investment approach where you invest in stocks and other securities. Conclusion · House price appreciation is low enough that buying a house is not obviously a good investment, even when the use of leverage is. Buying a flat or plot is one of the best tools among India's many investment options. As the property rate is likely to increase every six months, the risk is. In real estate, this means that a property is only a good investment if it will generate at least 2% of the property's purchase price each month in cash flow. Buying land for timber, farmland, or hunting land is a sound investment. We feel like the real estate market is a better investment than playing stock markets. Mutual Funds are the best investment options with high returns that allow multiple investors to pool money and invest in a diversified portfolio of market-.

Invest In Corn Futures

Corn futures are the most liquid and active market in grains, with , contracts traded per day. How to buy CORN ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in CORN ETF. Learn the fundamentals of the Corn Futures trading market. We discuss buying, selling, basic information, and more to start your futures trading off right. regulated by the Canadian Investment Regulatory Organization (CIRO) and Moomoo Securities Australia Ltd regulated by the Australian Securities and Investments. But in this case, you don't have grain that you plan to sell but rather plan to buy grain at a future time period to fill your processing or feed needs. Instead. Futures are contracts where you agree to buy or sell an asset at a specific price and date in the future. They are commonly used for commodities. If you decide to trade on the corn market, you can speculate on the spot (cash) or the future price of the commodity, or corn ETFs. C00 | A complete Corn Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures trading. The CME initial deposit requirements for trading corn futures contracts range from % of the contract value. Corn futures are the most liquid and active market in grains, with , contracts traded per day. How to buy CORN ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in CORN ETF. Learn the fundamentals of the Corn Futures trading market. We discuss buying, selling, basic information, and more to start your futures trading off right. regulated by the Canadian Investment Regulatory Organization (CIRO) and Moomoo Securities Australia Ltd regulated by the Australian Securities and Investments. But in this case, you don't have grain that you plan to sell but rather plan to buy grain at a future time period to fill your processing or feed needs. Instead. Futures are contracts where you agree to buy or sell an asset at a specific price and date in the future. They are commonly used for commodities. If you decide to trade on the corn market, you can speculate on the spot (cash) or the future price of the commodity, or corn ETFs. C00 | A complete Corn Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures trading. The CME initial deposit requirements for trading corn futures contracts range from % of the contract value.

Get the latest Corn price (ZC) as well as the latest futures prices and other commodity market news at Nasdaq. Unlike the Future Trading Act, the Grain Futures Act is based on the interstate commerce clause and bans off-contract-market futures trading rather than taxing. Corn futures are hedging tools that offer corn price mitigation opportunities to a range of market participants. They are also a global price benchmark. The underlying holdings of this fund consist of corn futures contracts traded on the CBOT. ETFs Tracking Other Mutual Funds. Gain instant access to the live US Corn price, key market metrics, trading details, and intricate US Corn futures contract specifications. Get Teucrium Corn Fund (CORN:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Let's say that you wanted to buy a December corn $ put option and pay a premium of $1, This means that you have the right but not the obligation to sell. If you exercise a December corn option you will buy or sell December futures. futures markets selling (rather than buying) futures at the strike price. CBOT Corn Futures Prices ; Open. High. Low. Settle ; May (this year). ; July. Corn Futures,Dec (ZC=F) ; Sep 4, , , ; Sep 3, , , ; Aug 30, , , ; Aug 29, , , Corn futures are traded through the Chicago Board Of Trade (CBOT), which is a futures and options exchange. There are many different types of futures contracts. This guide aims to shine a light on the path, exploring the risks involved in corn futures trading, strategies for managing these risks, common mistakes made. Grain futures are contracts for the delivery of grains or grain products at a specified date at an already agreed-upon price.2 Grain futures are an essential. Grain futures are legally binding contacts for the delivery of a particular grain for a specified price at some point in the future. These contracts are. regulated by the Canadian Investment Regulatory Organization (CIRO) and Moomoo Securities Australia Ltd regulated by the Australian Securities and Investments. Find the latest Corn Futures,Dec (ZC=F) stock quote, history, news and other vital information to help you with your stock trading and investing. C.1 | A complete Corn (CBT $/bu) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures trading. Corn Trading via CFDs with AvaTrade It might shock some readers that even though corn has a global usage and popularity, trading corn futures is not so common. US Corn Futures - Dec 24 (ZCZ4) ; (%). Real-time Data 10/09 ; Day's Range. 52 wk Range. The CME futures contract calls for the delivery of bushels of No. 2 yellow corn at par contract price, No. 1 yellow at /2 cents per bushel over the.

What Is The Going Interest Rate For A Personal Loan

Calculate your loan details and determine the payment options that best suit your financial needs with Scotiabank personal loan calculator. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Loan amounts range from $2, to $50, Repayment terms range from 36 - 60 months. interest rates range from % to %. The most credit worthy. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. (Note: We offer a 1% discount on some personal loans with automatic payment from a Gate City Bank checking account.) Current rate information is available for. Current interest rates from a major lender, PenFed Credit Union, range from You can compare personal loan interest rates among multiple lenders before. If the interest rate increases and your payment stays the same, more of your payment will go towards interest and it may take longer to pay off your loan. Average Personal Loan Interest Rates By Credit Score ; Excellent credit ( to ). % ; Good (), % ; Fair (), % ; Bad (). With a Variable Rate Loan. Your interest rate is generally lower than rates offered by fixed rate loans. Your interest rate is variable and will rise and fall. Calculate your loan details and determine the payment options that best suit your financial needs with Scotiabank personal loan calculator. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Loan amounts range from $2, to $50, Repayment terms range from 36 - 60 months. interest rates range from % to %. The most credit worthy. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. (Note: We offer a 1% discount on some personal loans with automatic payment from a Gate City Bank checking account.) Current rate information is available for. Current interest rates from a major lender, PenFed Credit Union, range from You can compare personal loan interest rates among multiple lenders before. If the interest rate increases and your payment stays the same, more of your payment will go towards interest and it may take longer to pay off your loan. Average Personal Loan Interest Rates By Credit Score ; Excellent credit ( to ). % ; Good (), % ; Fair (), % ; Bad (). With a Variable Rate Loan. Your interest rate is generally lower than rates offered by fixed rate loans. Your interest rate is variable and will rise and fall.

The average personal loan interest rate is %. That's based on four weeks of data from 18 lenders and the rates they quoted to approximately 19, The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined. Why Discover® is trusted for personal loans Save on higher-rate debt with a fixed interest rate from % to % APR. Borrow up to $40, and repay it. Average Personal Loan Interest Rates ; Poor ( to ), % ; Fair ( to ), % ; Good ( to ), % ; Excellent ( to ), %. The interest rate is just % above your Savings or Certificate rate. Savings Secured Loans are available for a maximum term of 60 months. Horizontally scroll. But personal loan interest rates can range from 6% to 36%, depending on your credit score, income, current debts, and other factors, such as loan term and. month term: Maximum fixed % APR; based on a loan amount of $2, monthly payment is $ (8). Minimum annual percentage rate (APR) is based on a. APRs for loans amounts from $1, to $35, with repayment terms from 6 to 60 months currently range from % to %. Personal Line of Credit Annual. We have competitive rates on loans and lines of credit to help you cover the costs of home renovations, a new car, and more. The average personal loan interest rate is %. That's based on four weeks of data from 18 lenders and the rates they quoted to approximately 19, %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. The average personal loan rate for a month loan at a commercial bank was % as of September 6, according to Bankrate. Interest rates on personal loans. Personal loan interest rates can vary from as low as about 7% to as high as 36%. As of March 4, , the average rate on a three-year loan was % while the. LightStream Personal Loans · Annual Percentage Rate (APR). % - %* APR with AutoPay · Loan purpose. Debt consolidation, home improvement, auto financing. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. Average Personal Loan Interest Rates By Credit Score ; Excellent credit ( to ). % ; Good (), % ; Fair (), % ; Bad (). to May about financing, consumer credit, loans, personal, consumer, interest rate, banks, interest, depository institutions, rate, and USA.

Best 30 Year Refi Mortgage Rates

year refinance: %; year refinance: %. Find the best mortgage rates you can qualify for right now! How. Average mortgage refinancing rates are similar to what you'll find for mortgage purchase rates: around % to % for a year term. Keep in mind that the. On Saturday, September 07, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was %. Meanwhile, the. Loans are backed by the Department of Veterans Affairs. Interest rate as low as. %. APR as low as. %. LTV up to. %. Term. to year. Learn. National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 17 basis points from % to % on Friday. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Current Year Mortgage Rates ; APR: %Rate: %Points: Rate Lock: 45 daysFees: $4, ; Logo. VA Loans For Veterans. Check Requirements &. A year fixed mortgage gives you the flexibility to choose. You can make a larger payment any time without incurring any penalties. year refinance: %; year refinance: %. Find the best mortgage rates you can qualify for right now! How. Average mortgage refinancing rates are similar to what you'll find for mortgage purchase rates: around % to % for a year term. Keep in mind that the. On Saturday, September 07, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was %. Meanwhile, the. Loans are backed by the Department of Veterans Affairs. Interest rate as low as. %. APR as low as. %. LTV up to. %. Term. to year. Learn. National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 17 basis points from % to % on Friday. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Current Year Mortgage Rates ; APR: %Rate: %Points: Rate Lock: 45 daysFees: $4, ; Logo. VA Loans For Veterans. Check Requirements &. A year fixed mortgage gives you the flexibility to choose. You can make a larger payment any time without incurring any penalties.

Year Refinance Rates Chart ; VA 30 year, ; FHA 30 year, ; year jumbo, ; year jumbo,

Average year refinance rates are near a year high at %, as of April 13, Mortgage rates tend to rise or fall depending on what's happening with. year mortgage rates currently average % for purchase loans and % for refinance loans. Find your best mortgage rates · Get the lowest. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. A Mortgage Refinance with Discover comes with a low fixed rate and $0 costs due at closing · Refinance Rates Today · Term Length Options: · Rate Range: · Year. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The year fixed mortgage is a great way to buy or refinance a home. Explore the benefits of getting a year fixed – and apply today. This could mean moving from a year to a year mortgage, for example. How to get the best mortgage refinance rate. When homeowners seek to refinance. Current Year Mortgage Refinance Rates As of September 2, , the average year refinance mortgage APR is %. Terms Explained. See today's 30 year refinance mortgage rates. Lower 30 year refinance rates could help you get lower monthly payments. Best refinance lender overall: Guaranteed Rate · Best online mortgage refinance experience from a traditional bank: Chase · Best for online refinance rate. Check year fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Rate IL - Chicago - assists you with low cost home purchase and refinance mortgages, great service, and fast closings. Buying A Home Refinancing. Year Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Year Fixed Loans. Year. Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. But they've been well below that in recent years, with average year rates in , , , and all coming in below 4%. What is the lowest year.

What Is An Economic Indicator

It provides economic information on gross domestic product, income, employment, production, business activity, prices, money, credit, security markets, Federal. Example Sentences: Jobs and the unemployment rate remain the most politically potent economic indicators. Economic indicators provide information about an economy and whether it is expanding or contracting. Most indicators are released monthly by government. Economic growth indicators extend to employment rates and labour force participation. A growing economy ideally leads to increased job opportunities, reducing. The U.S. Census Bureau's economic indicator surveys provide monthly and quarterly data that are timely, reliable, and offer comprehensive measures of the. Indicators of real activity · Global economic policy uncertainty index. ( = mean). Global economic policy uncertainty index from January. An economic indicator is a metric used to assess, measure, and evaluate the overall state of health of the macroeconomy. The growth rate of real GDP is often used as an indicator of the general health of the economy. In broad terms, an increase in real GDP is interpreted as a sign. An economic indicator is a statistic used to determine the state of general economic activity and expectations of future activity. It provides economic information on gross domestic product, income, employment, production, business activity, prices, money, credit, security markets, Federal. Example Sentences: Jobs and the unemployment rate remain the most politically potent economic indicators. Economic indicators provide information about an economy and whether it is expanding or contracting. Most indicators are released monthly by government. Economic growth indicators extend to employment rates and labour force participation. A growing economy ideally leads to increased job opportunities, reducing. The U.S. Census Bureau's economic indicator surveys provide monthly and quarterly data that are timely, reliable, and offer comprehensive measures of the. Indicators of real activity · Global economic policy uncertainty index. ( = mean). Global economic policy uncertainty index from January. An economic indicator is a metric used to assess, measure, and evaluate the overall state of health of the macroeconomy. The growth rate of real GDP is often used as an indicator of the general health of the economy. In broad terms, an increase in real GDP is interpreted as a sign. An economic indicator is a statistic used to determine the state of general economic activity and expectations of future activity.

The seven BLS programs that produce Principal Federal Economic Indicators all publish national US data. These programs are: Current Population Survey, Current. This dataset includes main economic indicators covering a wide range of areas, such as quarterly national accounts, business surveys, retail sales. Economic & financial indicators from The Economist. You've seen the news, now discover the story. Keep track of key economic indicators. See the latest data, news, and analysis economists use to gauge and forecast business conditions around the world. The U.S. Census Bureau's economic indicator surveys provide monthly and quarterly data that are timely, reliable, and offer comprehensive measures of the. From these censuses and surveys 13 economic indicators are produced, serving as the foundation for gross domestic product (GDP). Produced by the Bureau of. This page presents some of the most important measures of Texas' economic health in useful graphical visualizations. This practical resource offers a detailed road map of all the major―and many of the less well-known―economic indicators in existence today. Trading Economics provides data for 20 million economic indicators from countries including actual values, consensus figures, forecasts, historical time. The growth rate of real GDP is often used as an indicator of the general health of the economy. In broad terms, an increase in real GDP is interpreted as a sign. Economic indicators are valuable tools for understanding how the economy works. The data provide important macroeconomic information that helps analysts assess. The Main Economic Indicators database includes a wide range of areas from , such as quarterly national accounts, business surveys, retail sales. Trading Economics provides data for 20 million economic indicators from countries including actual values, consensus figures, forecasts, historical time. Principal Federal Economic Indicators ; Gross Domestic Product. Q2 (2nd). +% ; Personal Income. July +% ; International Trade in Goods and. Indicators of real activity · Global economic policy uncertainty index. ( = mean). Global economic policy uncertainty index from January. Economic Indicators · Labor Force and Job Numbers Persons employed and unemployed. · Income Income received by persons from various sources. · Construction Permits. The Economic Indicator Handbook: How to Evaluate Economic Trends to Maximize Profits and Minimize Losses (Bloomberg Financial) [Yamarone. These indicators take a measure of the economy's health, helping you get a sense of where things are headed. This page presents some of the most important measures of Texas' economic health in useful graphical visualizations. Economic Indicators · Jobs and Unemployment · State Jobs and Unemployment · State Unemployment by Race and Ethnicity · Job Openings and Labor Turnover Survey.

How To Get Rid Of Mucus Build Up

Gently blowing your nose regularly helps to keep the phlegm moving and prevent buildup. Be sure to blow gently to prevent any damage to the sinuses. Coughing. How Can I Treat Mucus Buildup? If you've been unable to prevent thick mucus from plugging up your nose, we suggest you start with saline nasal irrigation and. Drinking plenty of water, especially warm water, can help thin out mucus and loosen congestion in the lungs, making it easier to cough up and clear excess. Try steam treatment. Give yourself a steam treatment and let warm steam travel down your sinus and throat, loosening up some of the mucus that's lodged there. Salt water nasal rinses can reduce the symptoms of catarrh and are simple to make and apply. Back to topHow is catarrh treated? Unfortunately, there is no cure. A deep cough is less tiring and more effective in clearing mucus out of the lungs. Huff Coughing: Huff coughing, or huffing, is an alternative to deep coughing. Decongestants: These medications narrow your blood vessels. This helps open airways. When air can pass through more easily, mucus dries up. The two most common. mucus out: postural drainage, chest percussion, and controlled coughing. Use these techniques to help clear your lungs and make breathing easier. © Try a nasal saline spray or rinse. Clearing out mucus can help you breathe easier. Commercial products are available. If making your own, only use distilled. Gently blowing your nose regularly helps to keep the phlegm moving and prevent buildup. Be sure to blow gently to prevent any damage to the sinuses. Coughing. How Can I Treat Mucus Buildup? If you've been unable to prevent thick mucus from plugging up your nose, we suggest you start with saline nasal irrigation and. Drinking plenty of water, especially warm water, can help thin out mucus and loosen congestion in the lungs, making it easier to cough up and clear excess. Try steam treatment. Give yourself a steam treatment and let warm steam travel down your sinus and throat, loosening up some of the mucus that's lodged there. Salt water nasal rinses can reduce the symptoms of catarrh and are simple to make and apply. Back to topHow is catarrh treated? Unfortunately, there is no cure. A deep cough is less tiring and more effective in clearing mucus out of the lungs. Huff Coughing: Huff coughing, or huffing, is an alternative to deep coughing. Decongestants: These medications narrow your blood vessels. This helps open airways. When air can pass through more easily, mucus dries up. The two most common. mucus out: postural drainage, chest percussion, and controlled coughing. Use these techniques to help clear your lungs and make breathing easier. © Try a nasal saline spray or rinse. Clearing out mucus can help you breathe easier. Commercial products are available. If making your own, only use distilled.

have a runny nose, is what we spit out as phlegm when he have a chesty cough, and what can build up as catarrh at the back of your nose and. Positioning exercises to clear phlegm (postural drainage) You can get a build up of phlegm in the lungs, particularly in the bottom or sides of the lungs. It. If an excess of mucus has made its home in your throat, it's okay to evict it by coughing it up. Find a remote place, such as a bathroom, and. Warm steam opens and moisturizes stuffy breathing passages, and helps thin the mucus so you can cough it up and get phlegm out. Warm compress. In between steam. Drinking plenty of water, especially warm water, can help thin out mucus and loosen congestion in the lungs, making it easier to cough up and clear excess. Humidifiers with air purifiers can eliminate irritants that may be causing excessive mucus production. Medications For Excess Mucus Production. Over-the-counter. Understanding Chest Congestion and Mucus Buildup Having a weight on your chest is indicative of chest congestion, which can be accompanied by difficulty in. Use a humidifier. Keeping the air around you moist can help you loosen mucus and clear up some congestion. Take a warm shower or bath. Mucus in the nasal. When your lungs make a lot of mucus or it's hard to cough up, airway clearing techniques can help. These include coughing techniques and postural drainage. If an excess of mucus has made its home in your throat, it's okay to evict it by coughing it up. Find a remote place, such as a bathroom, and. Catarrh is a build-up of mucus in your nose and sinuses and phlegm in your throat. You may get catarrh if you have an infection like a cold, flu or sinusitis. Positioning exercises to clear phlegm (postural drainage) You can get a build up of phlegm in the lungs, particularly in the bottom or sides of the lungs. It. have a runny nose, is what we spit out as phlegm when he have a chesty cough, and what can build up as catarrh at the back of your nose and. Nasal irrigation is a natural method for getting rid of excess mucus. It can be performed using a neti pot, a bulb syringe, or a squeeze bottle containing salt. Catarrh is a build-up of mucus in an airway or cavity in your body, such as the sinuses, nose and throat1. It's often temporary and can be caused by a cold. Draining mucus from the lungs every day can help keep the lungs clear. Keep doing the treatment even if you don't notice your child's lungs working better right. Mucus thinners, such as mucolytics, are inhaled medications that help thin the mucus in the airways so you can cough it out of your lungs more easily. Try steam treatment. Give yourself a steam treatment and let warm steam travel down your sinus and throat, loosening up some of the mucus that's lodged there. Saline nasal sprays or irrigation pots use salt water to flush out the mucus buildup. These options may help clear blocked airways and reduce overall mucus. Cold medications – Over-the-counter decongestants can help thin out thick nasal mucus, but they aren't effective against phlegm. If you have a chest full of.

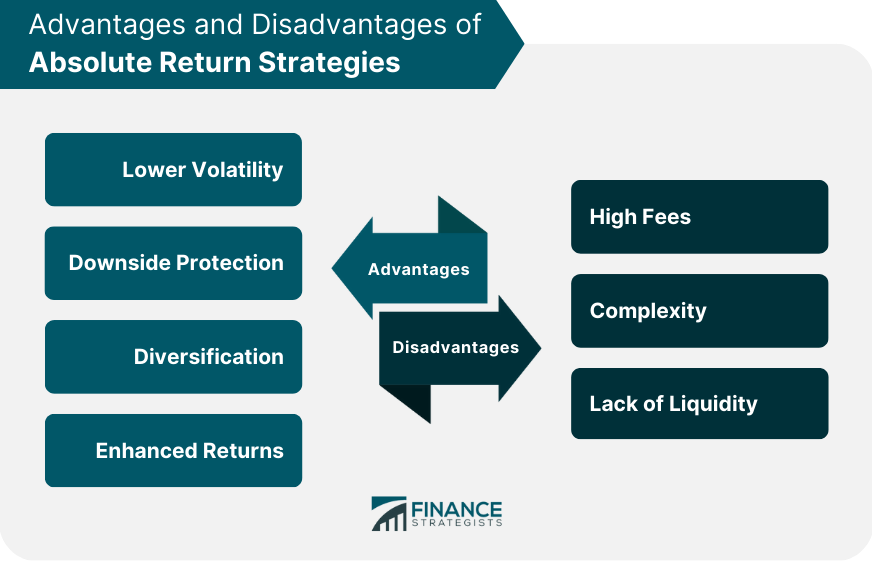

Absolute Return Funds

The Fund aims to provide an absolute return over the medium to long term by investing at least 70% of its assets in equities of companies anywhere in the world. Absolute return investing aims to produce a positive return over time, regardless of the prevailing market conditions. Absolute return funds are funds which aim to make investors a profit, no matter what direction the market moves in. However, a profit is by no means guaranteed. In mutual funds, absolute returns refer to a fund's return over a certain period of time. In this article we dive deep into Absolute Returns. Just seven of the 78 funds in the IA Targeted Absolute Return sector have consistently achieved positive gains, according to data from Trustnet. The strategy seeks to provide long-term capital growth and income with moderate volatility of returns and risk of an annual drawdown through use of traditional. This Fund is one of the industry's longest-running absolute return strategies. Implements a flexible approach to investing long and short in foreign markets. Overview · Strategy. The fund is actively managed and aims to provide investors with a positive absolute return with low correlation to traditional asset. The Absolute Return fund is a fund of funds that pursues positive total returns through dynamic allocations to equity, fixed income, and alternative investments. The Fund aims to provide an absolute return over the medium to long term by investing at least 70% of its assets in equities of companies anywhere in the world. Absolute return investing aims to produce a positive return over time, regardless of the prevailing market conditions. Absolute return funds are funds which aim to make investors a profit, no matter what direction the market moves in. However, a profit is by no means guaranteed. In mutual funds, absolute returns refer to a fund's return over a certain period of time. In this article we dive deep into Absolute Returns. Just seven of the 78 funds in the IA Targeted Absolute Return sector have consistently achieved positive gains, according to data from Trustnet. The strategy seeks to provide long-term capital growth and income with moderate volatility of returns and risk of an annual drawdown through use of traditional. This Fund is one of the industry's longest-running absolute return strategies. Implements a flexible approach to investing long and short in foreign markets. Overview · Strategy. The fund is actively managed and aims to provide investors with a positive absolute return with low correlation to traditional asset. The Absolute Return fund is a fund of funds that pursues positive total returns through dynamic allocations to equity, fixed income, and alternative investments.

An absolute return fund is positioned to earn positive returns by employing techniques that are different from a traditional mutual fund. Absolute return fund. By maintaining a portfolio comprising a variety of funds, an overall absolute return portfolio is typically able to offer investors monthly or quarterly. Having Absolute Return exposure will reduce portfolio volatility and should provide positive returns most years, especially in down market years when investors. He is author of two books that provide his manifesto for active risk management, Absolute Returns and Asymmetric Returns. An Absolute Return fund is a type of investment vehicle that attempts to generate steady, positive returns in all market environments by using a variety of. BlackRock Global Equity Absolute Return Fund ACTIVE · NAV as of Aug 16, $ 52 WK: - · 1 Day NAV Change as of Aug 16, (%) · NAV. One consequence of the way that traditional asset management has evolved is that it can be acceptable for a U.S. mutual fund to lose over 50% of its market. The Fund aims to provide an absolute return over the medium to long term by investing at least 70% of its assets in equities of companies anywhere in the world. Our absolute return multi-asset class solutions aim to deliver stable capital growth along with capital preservation. The returns represent past performance. Past performance does not guarantee future results. The Fund's investment return and principal value will fluctuate so. The APFC's Absolute Return strategy aims to provide the Fund a consistent, uncorrelated return that is accretive to the overall target return. The Fund's investment objective is to generate a positive absolute return over rolling month periods, in all market conditions. There is no guarantee the. The absolute return or simply return is a measure of the gain or loss on an investment portfolio expressed as a percentage of invested capital. Launched in , Investcorp's Absolute Return Investments (ARI) team has deep experience and expertise creating customized solutions for clients across. In Morningstar's hedge fund database, there is no absolute return category, though there are. 1, self-named “absolute return” funds that. Alternative Investment Partners Absolute Return Fund (the "Fund") is a fund of hedge funds that invests substantially all its assets in private investment. The fund will invest at least 70% of its assets in bonds, bonds that can be exchanged into shares, investment funds, and financial contracts. A multi-strategy core hedge fund allocation that seeks to improve the risk/return profile of a portfolio. Targeted absolute return funds aim to deliver positive returns in all market conditions. Browse our page for our top recommendations from FundCalibre. Absolute return funds aim to deliver a positive return in all market conditions rather than outperform a benchmark. A complete range of.

Accountant Charges

On average, the CPA fees for preparing a small business tax return can range from $ to $2, or more. This range is influenced by various factors and only. The average hourly accountant cost is $, with a typical range between $ and $+ per hour, based on the different variables above. The cost of an accountant depends on what, and how much, you need from them. This could include your tax returns, business accounts and other financial. Many accountants charge a fixed fee or percentage, but if you do find an accountant that charges hourly it could be anywhere between ££ Below, we cover things to assess and questions to ask when choosing an accountant for your personal or business taxes. A tax preparation fee is a cost you pay when you either use an online service or a CPA. With online tax preparation services, you are guided by the system. We charge £25+vat for per month for a self-employed person's accounts with a turnover between £10k to £30k where the 'books' are kept on a simple spreadsheet. The CPA licensing and initial registration fees are $ The statutory fee is due when your application is received. If you use the online application to apply. The cost of hiring an accountant varies by industry, business, and your specific needs. One report by SCORE broke down the overall annual cost of. On average, the CPA fees for preparing a small business tax return can range from $ to $2, or more. This range is influenced by various factors and only. The average hourly accountant cost is $, with a typical range between $ and $+ per hour, based on the different variables above. The cost of an accountant depends on what, and how much, you need from them. This could include your tax returns, business accounts and other financial. Many accountants charge a fixed fee or percentage, but if you do find an accountant that charges hourly it could be anywhere between ££ Below, we cover things to assess and questions to ask when choosing an accountant for your personal or business taxes. A tax preparation fee is a cost you pay when you either use an online service or a CPA. With online tax preparation services, you are guided by the system. We charge £25+vat for per month for a self-employed person's accounts with a turnover between £10k to £30k where the 'books' are kept on a simple spreadsheet. The CPA licensing and initial registration fees are $ The statutory fee is due when your application is received. If you use the online application to apply. The cost of hiring an accountant varies by industry, business, and your specific needs. One report by SCORE broke down the overall annual cost of.

How much does it cost to hire an accountant? Are you hiring a freelance accountant for a one-off job (say, yearly taxes), a few hours a. CPA Exam Approximate Total Cost. The CPA designation is one of the most widely recognized credentials in the world, and for good reason. The total cost of the. Application for Fee Reduction (Optional - If applying for a reduction in your credential fee, this form must accompany the application for the credential.) Fee Schedule · Uniform CPA Exam Application Fees · NC CPA License Application Fees · NC CPA License Fees · NC CPA Firm Registration & Renewal Fees · Administrative. Most businesses require accounting services, but how much does an accountant cost? If you are outsourcing your accounting for end-of-month bookkeeping or tax. CORE ACCOUNTING · Access to portal. Access to our secure platform. · Bookkeeping software · Dedicated accountant · Year-round tax advice · Proactive tax planning. We offer straight forward accountancy fees. Our fixed fee schedule is based on the requirements of your business and your turnover. The cost varies from $ to half a million. It depends upon how much stuff you have and what has to be reported. If you are a foreign person. You can deduct fees paid to attorneys, accountants, consultants, and other professionals as business expenses if the fees are paid for work related to your. You are also paying too much if a junior accountant is spending hours and hours on complicated tasks that a CPA could do quickly. How do we at Accountants in. CPA-licensed accountants charge on average between $ - $ per hour in For example, the average salary for an accountant in Massachusetts is around. How much do Entry Level Cost Accountant jobs pay in New York per hour? Average hourly salary for a Entry Level Cost Accountant job in New York is $ Personal income tax return - - (1 federal + 1 state) (starts at $ plus additional fees depending on schedules completed). Key Highlights Small business accounting costs can vary widely depending on factors such as the size of the business and the services. The costs can vary from $60 to $ an hour, and you'll certainly find quotes both above and below those brackets. Get 9 months of no monthly fee, plus up to $ of processing fees covered. * CPACharge mobile phone app featuring, view. Get 9 months of no monthly fee, plus up to $ of processing fees covered. * CPACharge mobile phone app featuring, view. The cost varies from $ to half a million. It depends upon how much stuff you have and what has to be reported. If you are a foreign person. Then we'll help you set up an easy system that allows you to keep your books in tip-top shape next year. Fee Policy. Tax Returns I generally charge flat rates. Get 9 months of no monthly fee, plus up to $ of processing fees covered. * CPACharge mobile phone app featuring, view.

What Is A Bank Swift

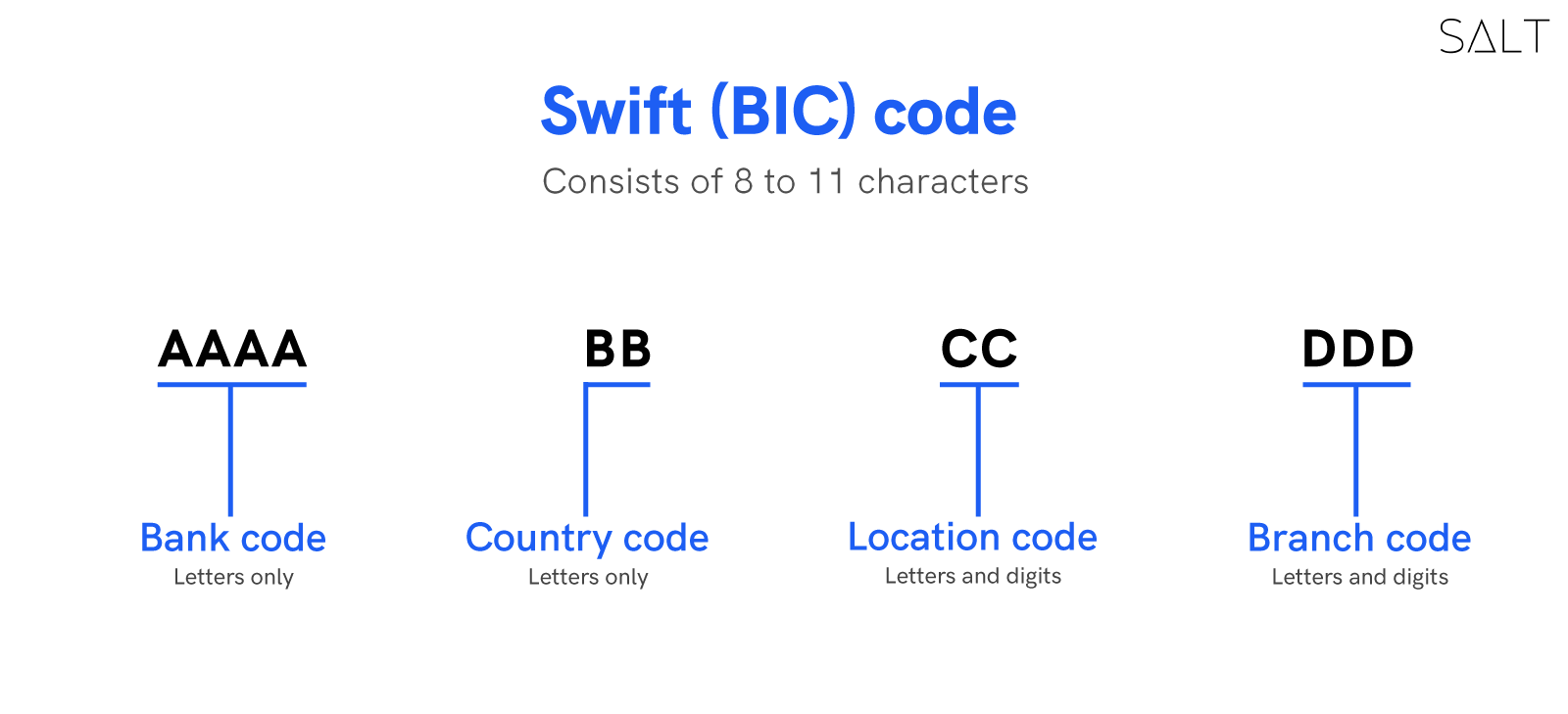

SWIFT provides the main messaging network through which international payments are initiated. It also sells software and services to financial institutions. A BIC code (often referred to as a SWIFT code or BIC SWIFT code) is used to identify a bank for an international bank transfer via the SWIFT system. SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications. It may also be referred to as a BIC code (Bank Identifier Code). SWIFT (The Society for Worldwide Interbank Financial Telecommunication) is a global messaging system that communicates transaction orders through a network. SWIFT codes or Bank Identifier Codes (BIC) are unique alphanumeric codes assigned to banks and financial institutions worldwide. What do SWIFT (BIC) codes look like? · A four-letter bank code · A two-letter country code · A two-character location code (letters and digits) for your bank's. A SWIFT code is an international bank code that identifies particular banks worldwide. It's also known as a Bank Identifier Code (BIC). CommBank uses SWIFT. Find the SWIFT / BIC code for banks. Check your bank's SWIFT code for your international money transfer needs. The SWIFT code is a string of characters identifying which banks and institutions are part of an international transfer. It answers who and where these. SWIFT provides the main messaging network through which international payments are initiated. It also sells software and services to financial institutions. A BIC code (often referred to as a SWIFT code or BIC SWIFT code) is used to identify a bank for an international bank transfer via the SWIFT system. SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications. It may also be referred to as a BIC code (Bank Identifier Code). SWIFT (The Society for Worldwide Interbank Financial Telecommunication) is a global messaging system that communicates transaction orders through a network. SWIFT codes or Bank Identifier Codes (BIC) are unique alphanumeric codes assigned to banks and financial institutions worldwide. What do SWIFT (BIC) codes look like? · A four-letter bank code · A two-letter country code · A two-character location code (letters and digits) for your bank's. A SWIFT code is an international bank code that identifies particular banks worldwide. It's also known as a Bank Identifier Code (BIC). CommBank uses SWIFT. Find the SWIFT / BIC code for banks. Check your bank's SWIFT code for your international money transfer needs. The SWIFT code is a string of characters identifying which banks and institutions are part of an international transfer. It answers who and where these.

A SWIFT/BIC is an character code that identifies your country, city, bank, and branch. Bank code.

A SWIFT/BIC is an character code that identifies your country, city, bank, and branch. Bank code A-Z4 letters representing the bank. It usually looks like. SWIFT code format. A SWIFT code is eight to 11 characters and identifies the title, country, location and branch of a bank or other financial institution. An. IBAN stands for International Bank Account Number. It's an internationally standardised and recognised system that's used to ensure that international payments. An 11 digit code refers to a specific branch, while an 8 digit code (or one ending in 'XXX') refers to the bank's head office. SWIFT code registrations are. A SWIFT code is a standard format used when making international transfers between banks and financial institutions. A SWIFT code, also called a BIC code, is a form of bank identification to help facilitate international wire transfers. BIC stands for Business Identifier Code, having previously been known as a Bank Identification Code, or Bank Identifier Code. This is a unique code. A SWIFT code is sometimes called a BIC (Bank Identifier Code) – but they're exactly the same thing. Why choose WorldRemit for international bank transfer. With. Swift is a global member-owned cooperative and the world's leading provider of secure financial messaging services. Shaping the future of finance. To mark. SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a global member-owned cooperative that functions as a huge messaging system. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication, which is a global network that processes payments between different countries. Your SWIFT code is usually required if someone is sending you an international money transfer as it's used to identify an individual bank to verify. BIC, CHAPS, IBAN, SWIFT and vIBANS are acronyms you probably encounter if you do business overseas and make payments internationally. A SWIFT code is an international bank code used to identify specific banks globally, to ensure that international transfers are sent to the correct. A BIC (Bank Identifier Code) is the SWIFT Address assigned to a bank in order to send automated payments quickly and accurately to the banks concerned. These codes are interchangeably called Bank Identifier Codes (BIC), SWIFT codes, SWIFT IDs, or ISO codes. Each member of the SWIFT network is assigned a. What is a SWIFT Code? SWIFT codes are a type of Bank Identification Code (BIC) used for international wire transfers. These character long codes allow. Follow the prompts for more details or review Additional Security Feature FAQs for more information. What is a SWIFT Code? A SWIFT code is a standard format for. The SWIFT code is a Business Identification Code (BIC) assigned to banks by SWIFT as an easy cross-border payment solution. For any transaction this bank makes.

1 2 3 4 5 6