safeonlinereputation.ru

Gainers & Losers

Whats A Good Thing To Invest In

The market is not good for shorter term investments (money you need to spend in the next 10 years or so) because of unpredictability. In that. Buying a flat or plot is one of the best tools among India's many investment options. As the property rate is likely to increase every six months, the risk is. You can consider different strategies, including the stock market, peer-to-peer lending, real estate investment, retirement plans, and even. While the stock market can be volatile at times, stocks are still a good choice if you're young. You can take advantage of low prices for top stocks. Plus, you. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. Investing Capital for Good · View More ABOUT US. What's Trending. Euromoney Could too much fixed income be a bad thing? Investment Strategy. Could too. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. What is a low-risk investment? A low-risk investment is designed to “Some good things about this are that you make money regularly, and you don. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. The market is not good for shorter term investments (money you need to spend in the next 10 years or so) because of unpredictability. In that. Buying a flat or plot is one of the best tools among India's many investment options. As the property rate is likely to increase every six months, the risk is. You can consider different strategies, including the stock market, peer-to-peer lending, real estate investment, retirement plans, and even. While the stock market can be volatile at times, stocks are still a good choice if you're young. You can take advantage of low prices for top stocks. Plus, you. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. Investing Capital for Good · View More ABOUT US. What's Trending. Euromoney Could too much fixed income be a bad thing? Investment Strategy. Could too. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. What is a low-risk investment? A low-risk investment is designed to “Some good things about this are that you make money regularly, and you don. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because.

Choices are a good thing. There are many ways to invest – and a lot of Your recommended investment strategy will be based solely on the information. After you've put a little effort into it, you can feel really good about investing, especially when things go well. What is it? How does it work? Who. There are four common types of investments: stocks, bonds, commodities and real estate. In addition, there are mutual funds and exchange traded funds (ETFs). Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. the best chance for investment success. Your success as an investor is While markets and financial returns may be hard to predict, one thing investors can. Also, market declines often represent a good opportunity to invest. What is the best way to invest when you have thousands of stocks to choose from. Some people like to invest in things they can physically own such as art, wine, whisky, gold bullion or even cars. Do your research before investing in any. What is a robo advisor? In this article, we explain everything you need to know about robo investing and whether it's right for you. Best Stock Market. Benefits of investing could include building wealth, increasing the value of your investment, and the ability to stay ahead of inflation. Audit your expenses and the attitude to the spending. Don't spend money on things you don't quite need or can't afford. 9. SAVE 10% FROM EACH PAYCHECK. The investing world has two major camps when it comes to how to invest money: active investing and passive investing. Both can be great ways to build wealth as. Before investing in a stock, it's a good idea to research the company and the stock's performance history. Questions you should ask about the investment and. Investing in yourself means actively working towards your personal growth and well-being. This could mean learning new things, honing your skills, or just. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Best stocks to buy ; Coca-Cola, KO ; Cadence Design Systems, CDNS ; Thermo Fisher Scientific, TMO ; Diamondback Energy, FANG. What is a Mutual Fund? Mutual funds continue to be among the most popular investing tools for both individual and professional investors who seek to beat the. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. investment, including worst-case scenarios. It's also a good idea to seek a second or even third opinion, especially when it comes to highly speculative.

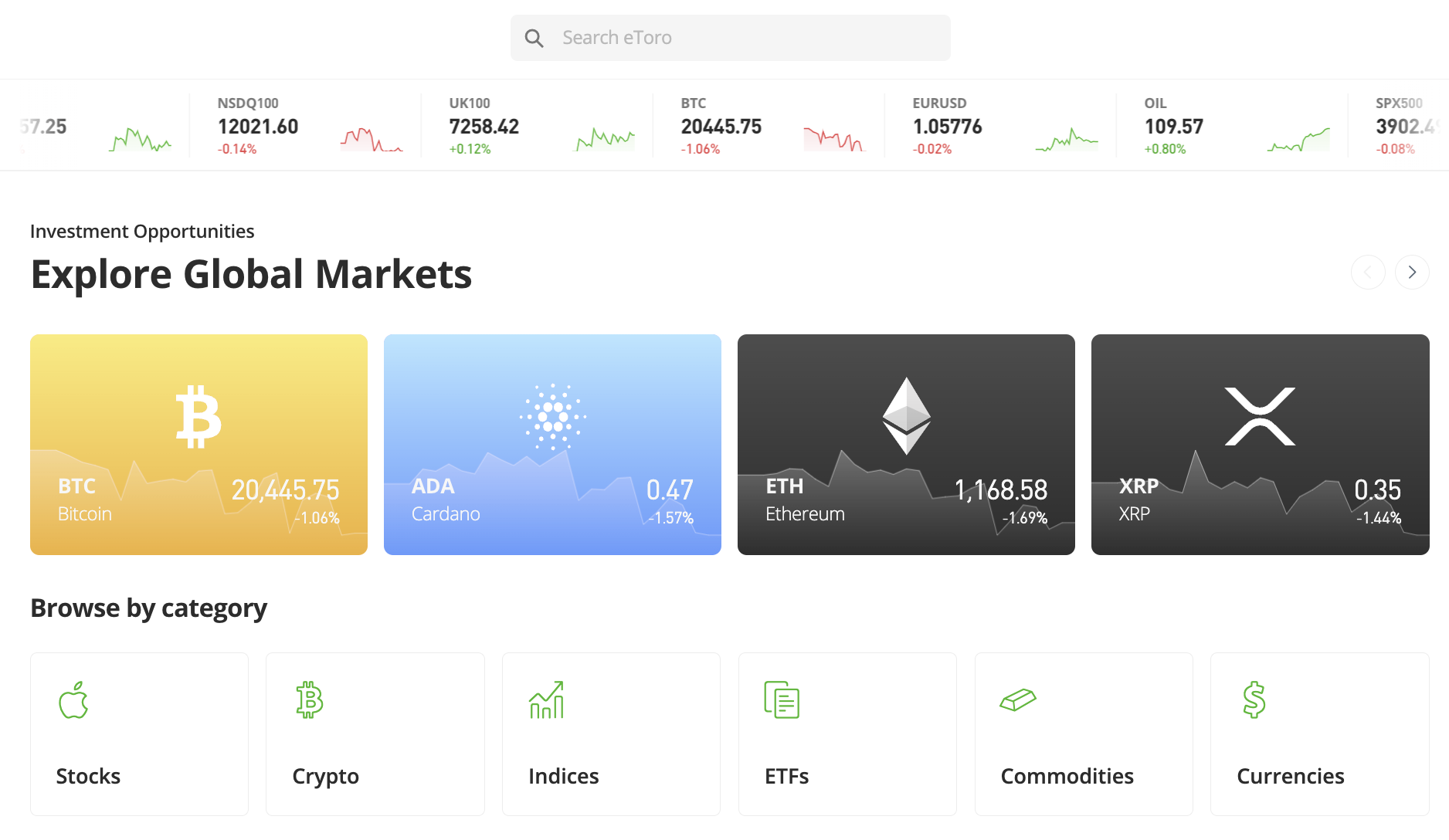

Highest Leverage Stock Broker Usa

With a % margin requirement on a low leverage broker platform, you will need at least $3, to setup this position. But if you were to trade with the high. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. + securities from the EU and the USA. Find out more. 1. Best for U.S. Traders and All Around Offerings: safeonlinereputation.ru · 2. Best for Advanced Traders: IBKR · 3. Best for CFD and Mobile Traders: Plus · 4. Best for Non-. While they do offer leverage, the trader will more than likely lose most if not all of their deposits using this kind of leverage. This broker also. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. For example, if you decide to use leverage when trading stocks Regulators have introduced margin requirements and maximum leverage limits in their. In this guide, we will talk about stockbrokers, who provide high leverage (because everyone loves high returns). Yes, it is perfectly safe to use a high leverage broker, but stick like glue to regulated ones such as eToro, EightCap, safeonlinereputation.ru, AvaTrade, or EuropeFX. Can. Saxo Bank is a global broker that is regulated by multiple authorities, including the NFA and CFTC in the United States. Saxo Bank offers competitive spreads. With a % margin requirement on a low leverage broker platform, you will need at least $3, to setup this position. But if you were to trade with the high. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. + securities from the EU and the USA. Find out more. 1. Best for U.S. Traders and All Around Offerings: safeonlinereputation.ru · 2. Best for Advanced Traders: IBKR · 3. Best for CFD and Mobile Traders: Plus · 4. Best for Non-. While they do offer leverage, the trader will more than likely lose most if not all of their deposits using this kind of leverage. This broker also. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. For example, if you decide to use leverage when trading stocks Regulators have introduced margin requirements and maximum leverage limits in their. In this guide, we will talk about stockbrokers, who provide high leverage (because everyone loves high returns). Yes, it is perfectly safe to use a high leverage broker, but stick like glue to regulated ones such as eToro, EightCap, safeonlinereputation.ru, AvaTrade, or EuropeFX. Can. Saxo Bank is a global broker that is regulated by multiple authorities, including the NFA and CFTC in the United States. Saxo Bank offers competitive spreads.

Top Forex Trading Brokers With High Leverage · 1. Fusion Markets. Min Deposit. $0 · 2. AvaTrade. Min Deposit. Credit card and wire transfer: $ · 3. FP Markets. Comparison of the Best Forex Brokers With High Leverage for ; Exness. ; FXTM. ; ZFX. ; 4. HFM. ; 5. CPT Markets. Merrill Edge · Overview. Merrill Edge is a full-service broker that offers high-quality tools for traders while still catering to investors looking to get. Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more. The broker with the highest margin trading leverage for stocks in the United States is Interactive Brokers. They offer up to 6x leverage for. Comparison of the Best Forex Brokers With High Leverage for ; Exness. ; FXTM. ; ZFX. ; 4. HFM. ; 5. CPT Markets. We recommend Pepperstone as the best Australian high-leverage forex broker offering the maximum leverage for forex trading. Here at CAPEX, traders get to trade with the highest leverage and lowest trading fees. Especially when it comes to trading Forex, our leverage for retail. Experience secure and flexible trading with Ox Securities. Leverage up to , spreads from , and a wide range of trading products. Some retail FX regulators limit the maximum leverage on currency pairs to , , or similar. Obviously, these brokers are acting outside of jurisdictions. After hundreds of hours of comprehensive research, data analysis, and live broker platform demos, Interactive Brokers (IBKR) is our best overall online. Who is the best high leverage stock brokers investment platform broker?The best High Leverage Stock Brokers Investment Platform broker is IC Markets. in United States. Leverage in the context of the foreign exchange market involves a contractual agreement that allows the usage of finances borrowed in a bid to. safeonlinereputation.ru is a broker with high leverage that helps you trade on the financial markets. It provides trading in stocks, commodities, forex, and more. Capital. Start forex trading with Tickmill and trade with low spreads & high leverage on CFD currencies, stock, commodities, indices, bonds, options, metals & more. Trading on stocks with leverage, for example, would mean opening a position with a broker and loaning most of the position's value amount – depending on the. Indices tend to have quite low margin rates and therefore high leverage ratios of approximately Leveraged stock trading. Another market with a relatively. Trading in ETPs may not be suitable for all types of investors as they carry a high degree of risk. You may lose all of your initial investment. Only speculate. Margin is equity from your account set aside by safeonlinereputation.ru to maintain a position when you're trading on leverage. USA. GAIN Capital Group LLC is a.

2 3 4 5 6